Welcome to the 34th edition of Markets, Distilled — your edge on where capital’s flowing across the exponential age.

Report Highlight: Memory

On April 22, we called the next AI bottleneck—shifting from compute to memory.

Since then, our top picks have surged: MU (+56.09%) and SK Hynix (+69.45%), riding the HBM wave.

Join 250+ readers staying ahead of the curve on exponential age trends.

1. Market Overview:

A. Will Altcoins Rally?

BTC just broke ATHs—and OTHERS dominance is creeping up, hinting at a risk-on altcoin shift.

But BTC open interest still dominates. The last cycle peak came when OTHERS' OI flipped BTC’s (Dec 8). That’s your scale-out signal.

Source: Coinalyze

B. Gold Sideways, Beta Metals Up:

Gold is flat—but liquidity is rotating into silver and platinum, both hitting multi-decade highs and outperforming YTD.

The drivers? Soaring industrial demand, supply deficits, and mining disruptions are squeezing prices as investors chase torque down the metals curve.

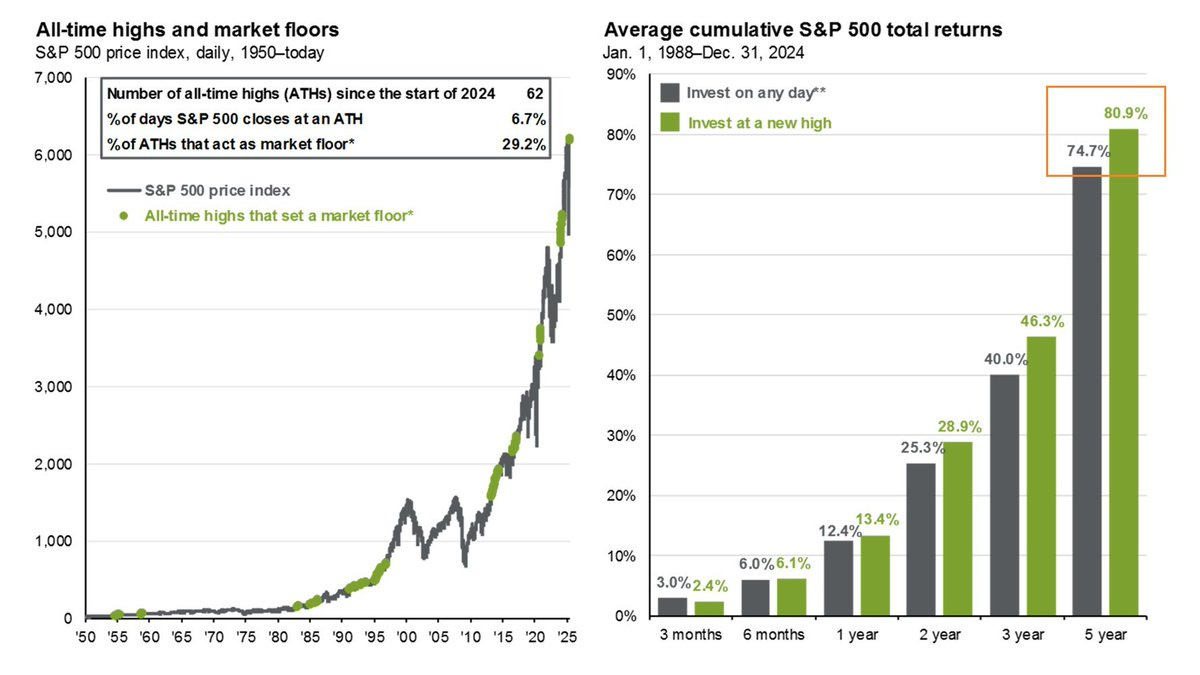

C. Buy High, Sell Higher:

Worried about buying at ATHs? History says don’t be—SPX returns post-ATH have outperformed over 1–5 years.

With rate cuts looming, macro supports the breakout. ATHs aren’t a ceiling—they’re often the launchpad.

Source: Barchart on X

Keep reading with a 7-day free trial

Subscribe to Markets, Distilled to keep reading this post and get 7 days of free access to the full post archives.