Dear Crypto, Distilled Family,

Exciting news! Starting today, and every Tuesday and Thursday moving forward, I'll be curating my top X threads right here on Substack.

Why? Because I've noticed that a lot of the valuable insights I share on X can get lost in the platform's cluttered layout.

Each curated thread will dive deep into key trends and insights, providing you a lasting resource to navigate the market.

I hope you find these collections to be an invaluable educational addition alongside our tri-weekly newsletter!

1. The Bull Run - Key Exit Strategies:

Imagine it’s Q4 2024: Bitcoin is at $80k and altcoin season has finally arrived.

Amidst this market euphoria, relying on gut instincts to time the market top can be extremely tempting.

However, a strategic approach can provide a more reliable path to success. Here’s a curated guide to crafting effective exit strategies:

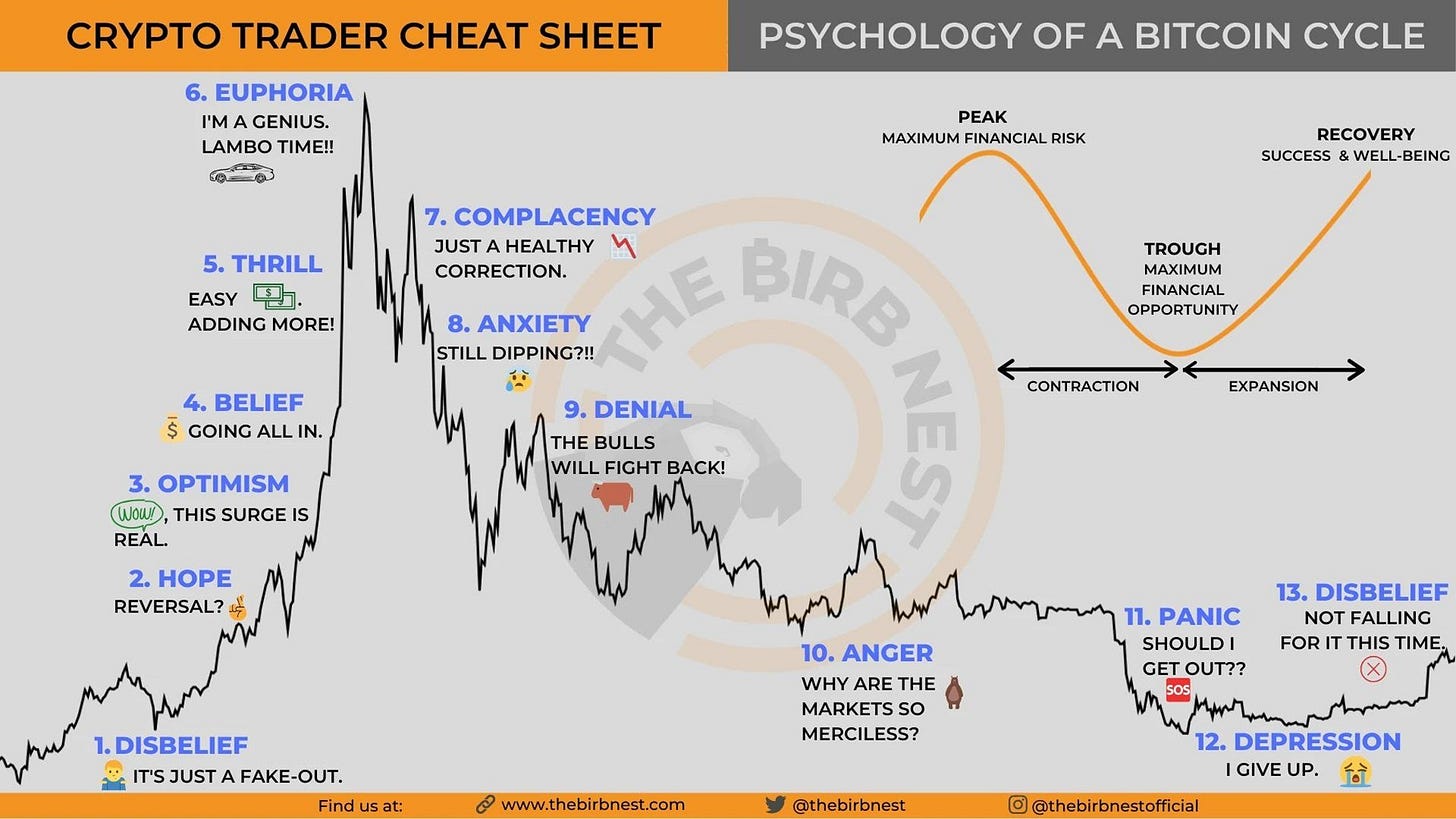

2. Pitfalls Of Price Predictions:

Relying solely on price targets to manage investments is fraught with risk.

These targets are often subjective, driven by emotions or influenced by social media, making accurate predictions and timing extremely challenging.

Source: NewTraderU

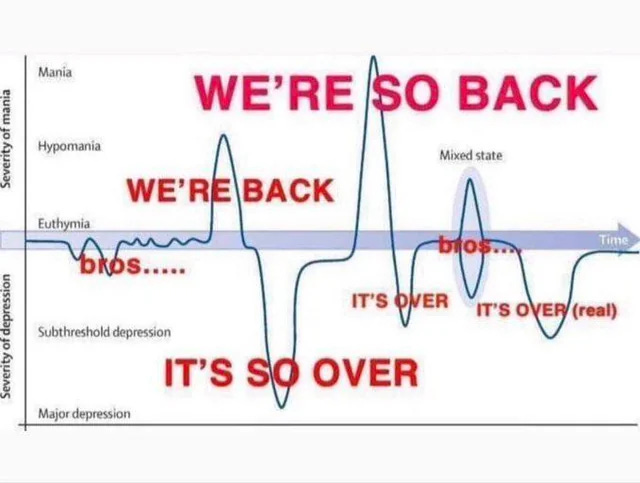

3. The Mind's Tactical Advantage:

As your portfolio grows, so does the psychological battle between fear and greed.

Each market fluctuation can challenge rational thinking, shifting goalposts, amplifying confirmation bias, and weakening discipline.

This internal struggle becomes more intense as stakes rise.

Source: Kyle Hill

4. The Power Of Thesis Investing:

Beyond price and emotion, thesis investing offers a robust strategy.

A well-crafted thesis is a reasoned argument for a project's potential over a defined timeframe, supported by clear, testable metrics.

This approach helps manage investments objectively, eliminating emotional biases and providing clear validation and invalidation points.

Source: Unsplash

5. Creating A Thesis:

A strong thesis is versatile and not solely tied to price. It should be testable, allowing for precise and adaptable management.

For example, instead of setting a past all-time high as a target, focus on key performance indicators (KPIs) like TVL or the number of active wallets.

Source: Lanturn

6. Example Strategies:

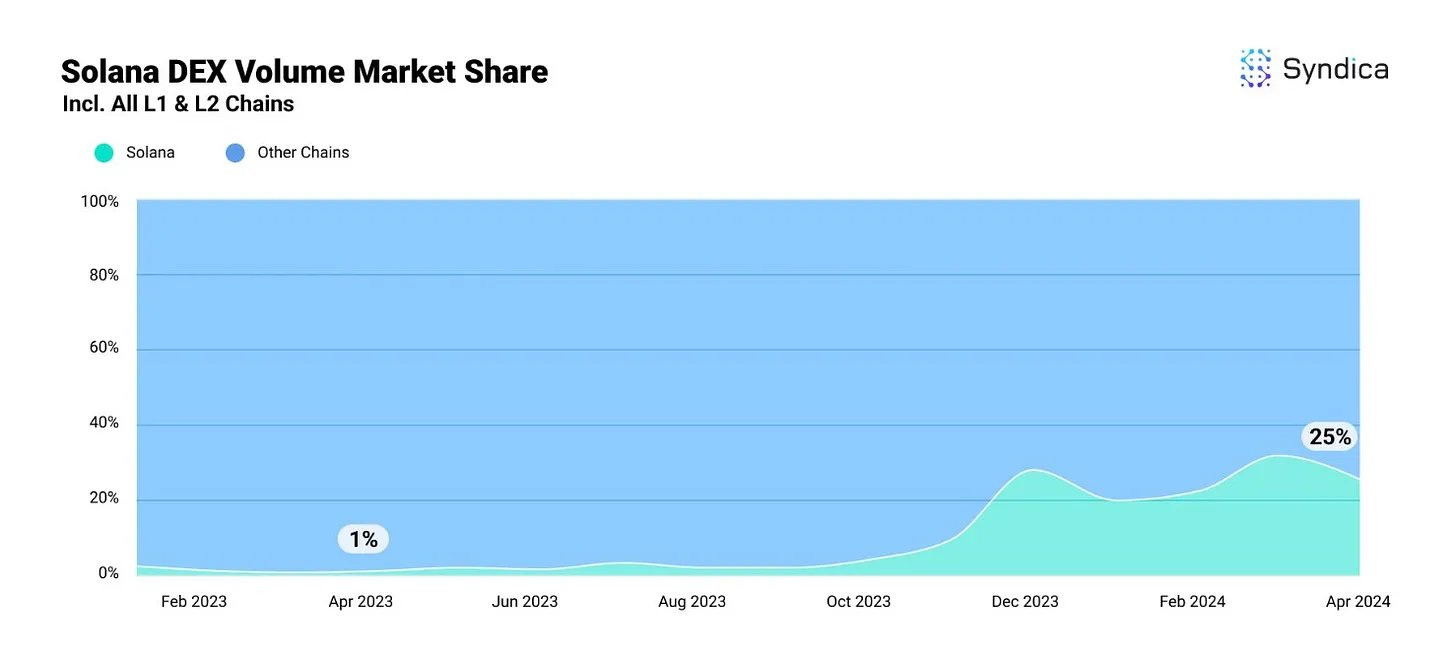

Layer 1 Protocols: For a Layer 1 protocol, instead of aiming for past price highs, consider metrics like relative market share or the number of active wallets.

AI Projects: For new projects, such as those involving AI agents, you could track KPIs like the number of on-chain agent transactions.

Roadmap Checkpoints: For projects with minimal viable products or no live product, focus on roadmap milestones and event execution.

Sometimes exiting after a milestone is confirmed is more strategic than waiting for the event to occur

Example: Tracking Solana’s DEX Volume Market Share

Source: Syndica

7. Alternative Strategies:

If a complex thesis strategy isn't for you, consider these alternatives:

Relative Outperformance: Focus on coins that are likely to accelerate faster than others. Sell portions of your holdings as they reach specific market cap rankings.

Fear & Greed Strategy: Use the market’s fear and greed index to time your exits, employing a weighted dollar-cost averaging (DCA) strategy to secure gains before sentiment shifts.

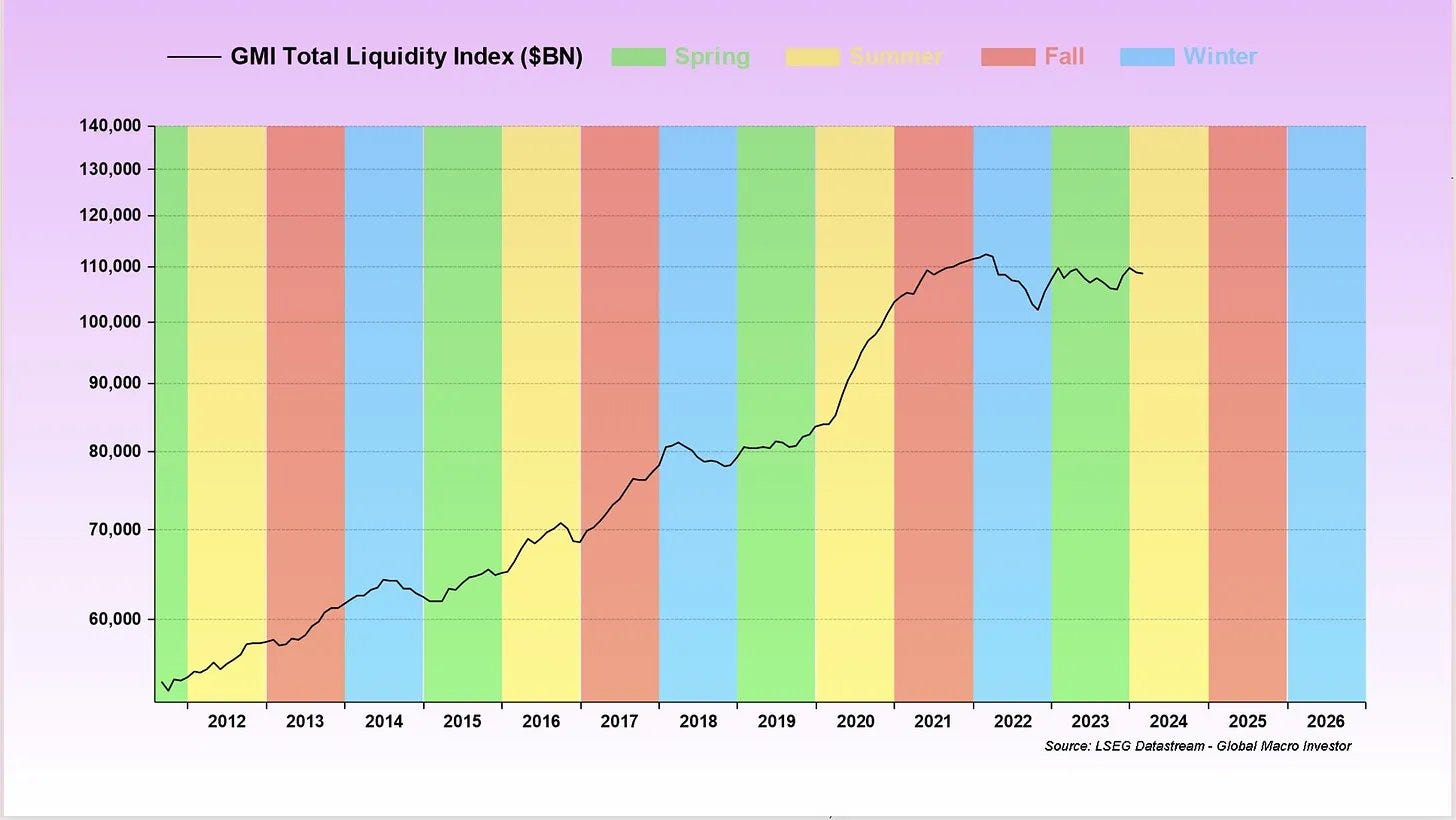

Time-Based Strategy: Sell a small percentage of your portfolio at regular intervals, adjusting based on macro factors and liquidity.

For example, you could use the stages of the four-year liquidity cycle:

Source: Raoul Pal

8. Final Thoughts:

As altcoin season unfolds, a well-prepared exit strategy can help you maximize gains while minimizing risks.

By avoiding the pitfalls of emotional decision-making and adopting a strategic, balanced approach, you can navigate this bull run with confidence.

Disclaimer:

Please note that all content is for informational purposes only and should not be considered financial advice. For full details, see the disclaimer.