Welcome to the 36th edition of "Crypto, Distilled" – your concise biweekly insight into the world of cryptocurrency.

Our goal is to aggregate and distill crypto trends, news and insights, purely for informational and entertainment purposes—not financial advice.

Market Overview:

In the past week, the crypto market has thrived. Bitcoin surpassed the significant $35k mark, while many altcoins saw considerable gains.

Bitcoin Monthly Chart Looks Strong:

Bob Loukas, a macro analyst, highlights that Bitcoin's monthly chart is impressive, showcasing 2023 highs after a steady 5-month phase without declining.

He suggests that Bitcoin is optimally positioned in its 4-year cycle, with the recent surge to $35k underlining its bullish momentum.

Solana (SOL) Surges:

Solana has also seen impressive gains, rising 25% this week and 80% over the past month.

A bustling ecosystem is fuelling this performance.

Solana's Total Value Locked (TVL) – an indicator of ecosystem adoption – has increased by 26.5% between Oct. 1st and Nov. 1st.

Notably, Marinade Finance, a leading staking protocol on Solana, witnessed a 180% TVL growth in October.

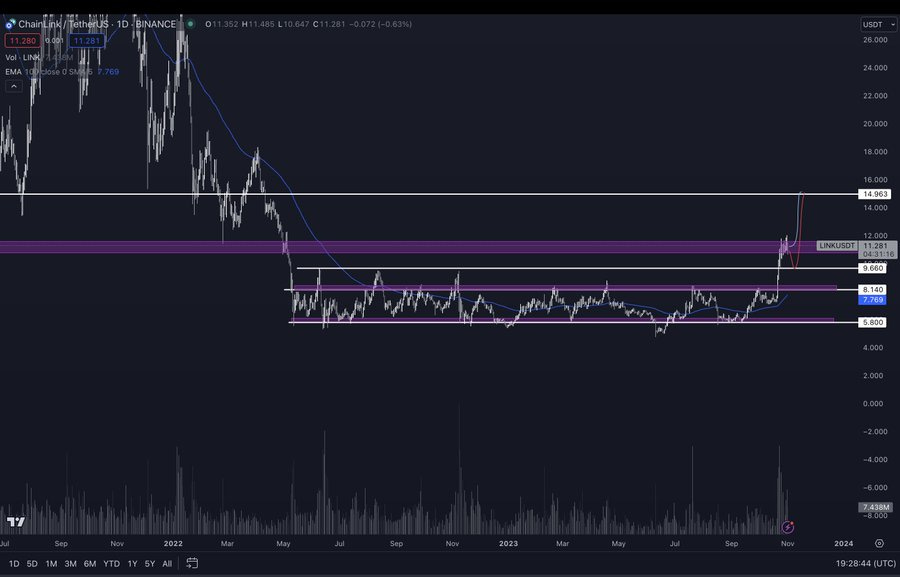

Chainlink (LINK) Range Breakout:

After consolidating for more than a year, Chainlink has made a notable breakout on its daily chart, exhibiting strong momentum.

Prominent crypto analyst, Pentoshi, who has a following of 700k on Twitter, believes that even if Chainlink retraces to its recent highs, its upward trajectory is clear, following a 2-year range break.

Understanding the Market Cycle - Is It Disbelief?:

I believe Bitcoin is currently navigating the "disbelief" phase and might transition to the "hope" phase in the upcoming 6-12 months.

A significant number of investors are still anticipating a downturn, but this sentiment often sidelines them. Such market psychology typically ensures they remain out of the game until a late-stage, often near the peak, when they feel compelled to adopt a bullish stance.

Greed & Fear Index:

Assessing social sentiment offers valuable insights into market momentum and trajectory. Typically, the market oscillates slowly between bullish (greedy) and bearish (fearful) attitudes, often settling in one sentiment for extended durations.

The accompanying chart indicates a fear and greed scale ranging from 0-100. This metric factors in market volatility, social media analytics, and Bitcoin dominance.

Current data suggests we are veering towards the greedier side, reminiscent of the late 2020 mood, which marked the onset of a bullish market. While predictions remain tentative, the improved sentiment hints at a promising outlook for the next 6-12 months.

News Highlights:

BlackRock's BTC ETF Attracts Major Players

Michael Saylor's Winning Bitcoin Blueprint

Solana's Surge & The Rise of Firedancer

BlackRock's BTC ETF Attracts Major Players:

BlackRock's anticipated Bitcoin ETF might gain a significant boost in liquidity.

Major trading powerhouses such as Jane Street, Virtu Financial, Jump Trading, and Hudson River Trading are reportedly exploring a key market-making role, pending regulatory approval for the ETF.

Michael Saylor's Winning Bitcoin Blueprint:

MicroStrategy's astute investment in Bitcoin, holding a substantial 158,400 BTC, has yielded an impressive paper profit of $900 million. This tactic has propelled MicroStrategy ahead of various major asset indices, leading tech equities, and enterprise software stocks.

The ascent is further fueled by optimism surrounding potential Bitcoin spot ETF approvals. Underscoring this strategy, Saylor states, "Our unwavering commitment to Bitcoin is anchored by its promising prospects for widespread institutional adoption."

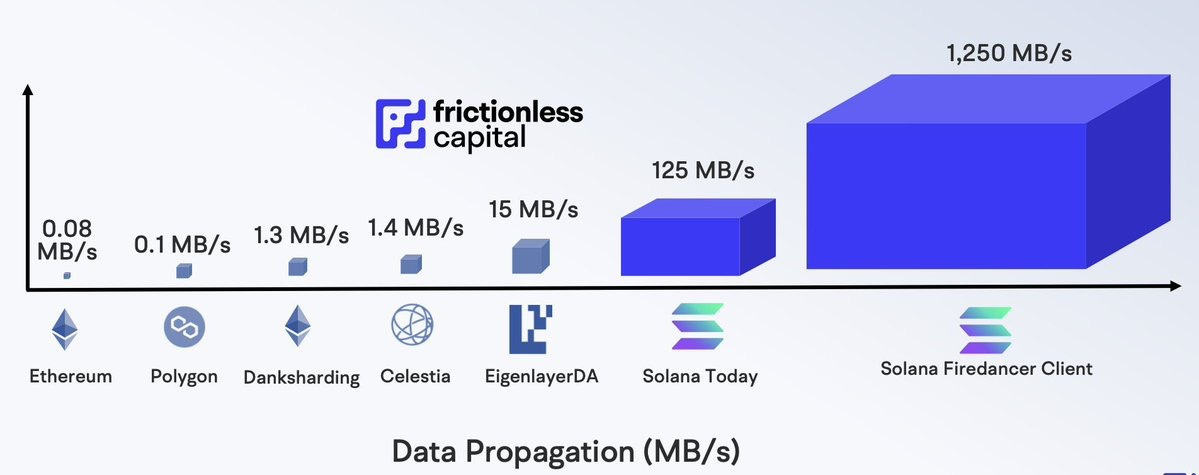

Solana's Surge & The Rise of Firedancer:

Solana has experienced an 80% uptick this month coinciding with the testnet launch of Firedancer, a new validator client designed to enhance network performance.

At the Breakpoint conference on October 31, Dan Albert from the Solana Foundation unveiled the testnet launch of Firedancer. Developed by Jump Crypto since the previous August, Anatoly Yakovenko, the leader of Solana Labs, highlighted Firedancer's promise to boost speed, enhance reliability, and broaden the range of network validators.

Marked for a mainnet launch in early 2024, Firedancer promises to be the solution to previous network setbacks that Yakovenko referred to as a "curse".

Key Market Trends:

Record Institutional Influx Since July 2022:

A remarkable $326 million has flowed into Bitcoin and altcoins, marking the most substantial institutional capital influx since July 2022, as per CoinShares.

Source - Coin Shares

The looming possibility of a Bitcoin ETF has seen Bitcoin garnering a significant 90% of institutional inflows. However, CoinShares points out that such inflows, while notable, aren't historically exceptional for Bitcoin, suggesting some investor hesitancy.

Interestingly, Solana is drawing attention with its capital inflows surpassing those of Ethereum. With Ethereum recording net outflows this year, it suggests a potential shift in preference among Layer 1 blockchains.

Open AI Day - November 6th:

The upcoming OpenAI DevDay stands out as the month's pivotal AI conference. Its prominence is arguably a driving force behind the recent surge witnessed in the AI segment of the crypto market.

As AI technology progresses and intertwines with blockchain, such events can catalyze innovations and investment activities in the crypto sphere. Key leaders at the moment include Bittensor (TAO and Autonolas (OLAS). I wrote a thread on each here.

Bitcoin's Rising Stature Against U.S. Treasury Bonds:

Bitcoin's valuation, when measured against U.S. Treasury bonds, is nearing it’s all time high.

The 'flight to safety' narrative championed by BlackRock's CEO underscores the increasing view of Bitcoin as a potential haven in uncertain financial times.

As traditional financial systems face challenges, investors are continually seeking assets that offer stability and reliability. Bitcoin's decentralized nature and limited supply make it an attractive candidate for this role.

Weekly Tips:

Strategizing For Bull vs. Bear Markets

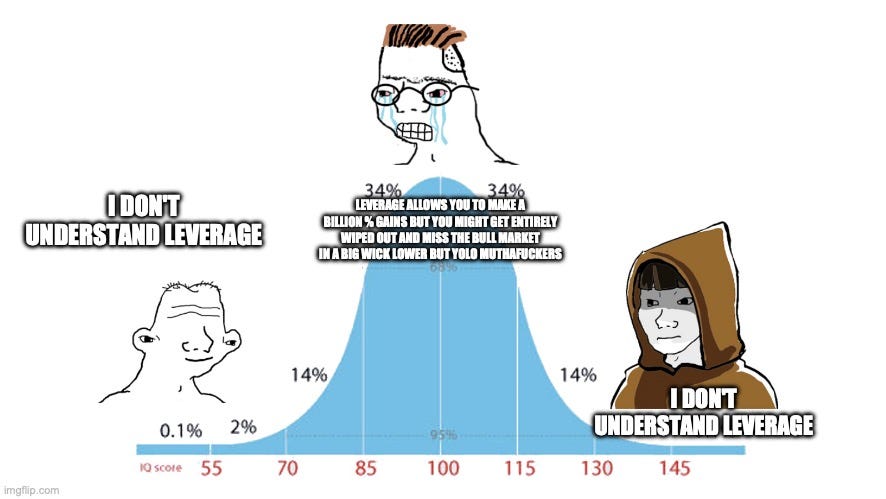

The Double Edged Sword Of Leverage:

Disclaimer:

All views are my own and are not financial advice.

Crypto is extremely risky, so it is important to always do your own research.

Keep reading with a 7-day free trial

Subscribe to Markets, Distilled to keep reading this post and get 7 days of free access to the full post archives.