Welcome to the 48th edition of "Crypto, Distilled," your 5-minute biweekly edge in the crypto market.

Please note that the content is for informational purposes only and should not be considered financial advice. For full details, see the disclaimer.

Market Overview:

Over the past week, Bitcoin experienced a decline in its value, while several major altcoins demonstrated resilience and strength.

Notably, Solana, Avalanche, and Cardano stood out as top performers during this period.

Assessing Bitcoin's Risk: A Possible 20% Correction

Macro analyst Jason Pizzino identifies a possible 20% correction for Bitcoin as a notable risk in the short-to-medium term.

Such corrections, while significant, can be a natural aspect of an overall upward market trend. This insight highlights the need for strategic readiness in the face of crypto market volatility.

Avalanche & Solana Outperform:

While Ethereum dominates with over 50% of the Total Value Locked (TVL) across blockchains, its price growth this year has been overshadowed by Solana and Avalanche.

The market valuation of SOL and AVAX compared to ETH is approaching record levels, last witnessed during the 2021 bull market.

News Highlights:

Yellen Foresees Inflation Decreasing to Around 2% by Late 2024:

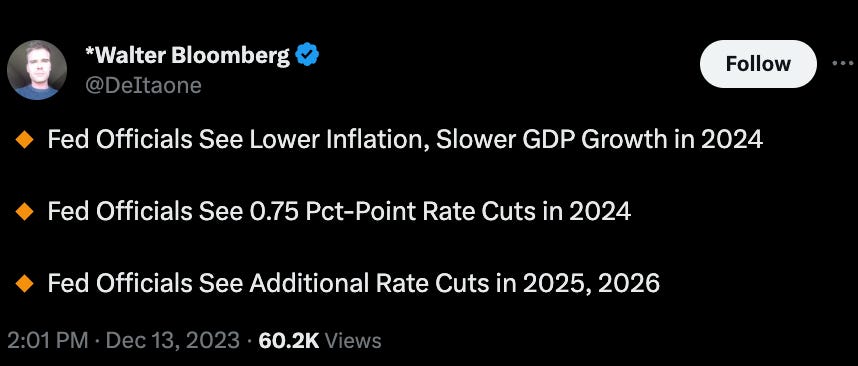

Janet Yellen anticipates a decrease in inflation to approximately 2% by the end of 2024. She explains that as inflation declines, a corresponding reduction in interest rates is expected to prevent a rise in real interest rates and avoid tightening financial conditions.

This forecast aligns with key points from the December FOMC meeting:

Bitcoin And Crypto To Be Measured At Fair Value Under New FASB Rules

Under the new Financial Accounting Standards Board (FASB) rules, starting December 15, 2024, companies will report cryptocurrencies like Bitcoin at their fair value.

The FASB's decision to adopt fair value accounting for cryptocurrencies, including Bitcoin, represents a notable shift in corporate financial practices.

As noted by analyst Will Clemente, this move reclassifies Bitcoin from an intangible to a financial asset on corporate balance sheets.

This allows for the recording of unrealized gains, enhancing Bitcoin's attractiveness as a reserve asset for corporate treasuries and potentially spurring wider corporate adoption.

Coinbase to Offer Spot Crypto Trading Outside US in Global Push

As part of its global expansion strategy, Coinbase Global Inc. is launching spot cryptocurrency trading on its international platform. This move addresses concerns among some users about the uncertain regulatory environment in the U.S.

Starting Thursday, institutional investors will have the opportunity to trade Bitcoin and Ether against the USDC stablecoin on this platform, which previously concentrated on derivatives trading, according to the company's recent announcement.

Key Market Trends:

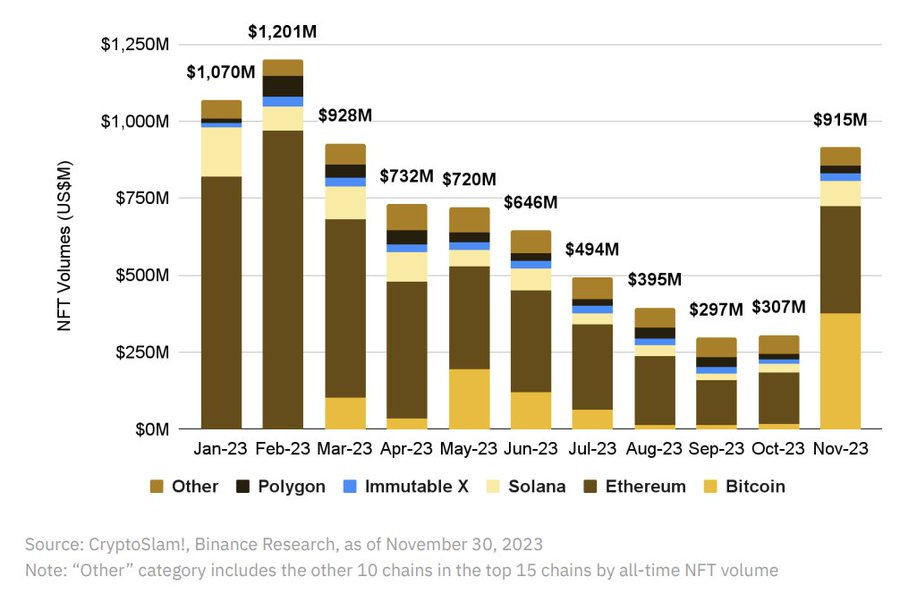

Rising NFT Volumes Indicate Shift In Crypto Market Sentiment:

NFT trading volumes, a critical yet sometimes underappreciated indicator, are showing a significant increase, reflecting changes in the crypto market sentiment.

NFTs are seen as high beta assets in the crypto world, meaning they're highly sensitive to market changes.

This surge in trade volumes, particularly noted in November, marks a break from the yearly trend, signaling a notable shift in investor behavior and market dynamics.

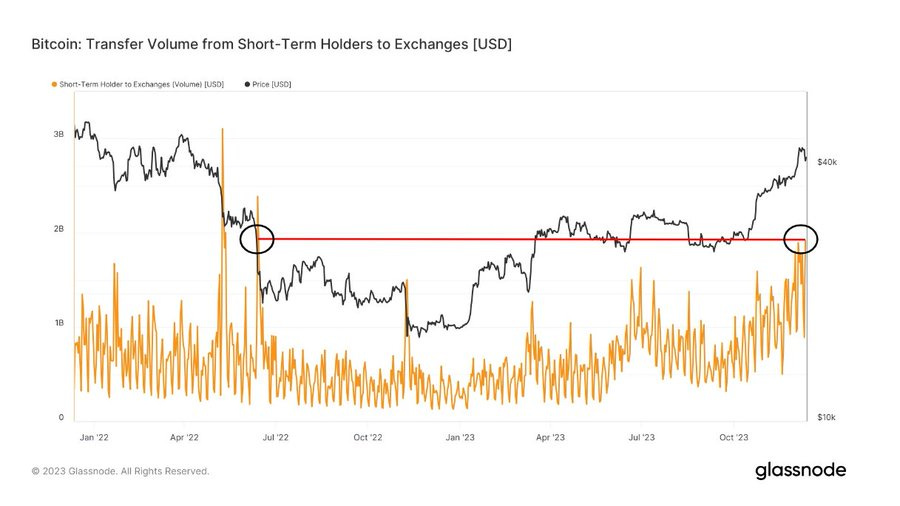

Significant Short-Term Holder Sell-Off In BTC: Largest Since Terra Luna

Earlier this week, the market saw The biggest short-term holder sell-off in Bitcoin since Luna and eclipsed last week's sell-off.

Over $2B in total, with $1.1B in loss. Namely, for anyone who bought between Dec. 6 and Dec. 13, most likely retail, after seeing Bitcoin up 150% YTD.

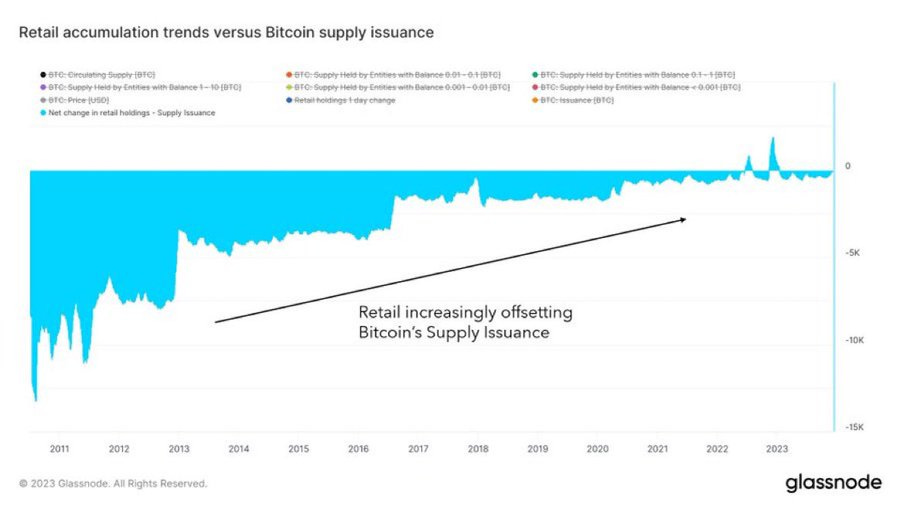

Retail BTC Accumulation Poised To Offset Supply Issuance Post-Halving

On-chain data shows that retail investors holding less than 1 Bitcoin are accumulating enough supply to significantly impact Bitcoin's overall issuance.

If current trends continue, this retail accumulation is expected to fully counterbalance new Bitcoin issuance for the first time since its inception, especially after the upcoming halving event."

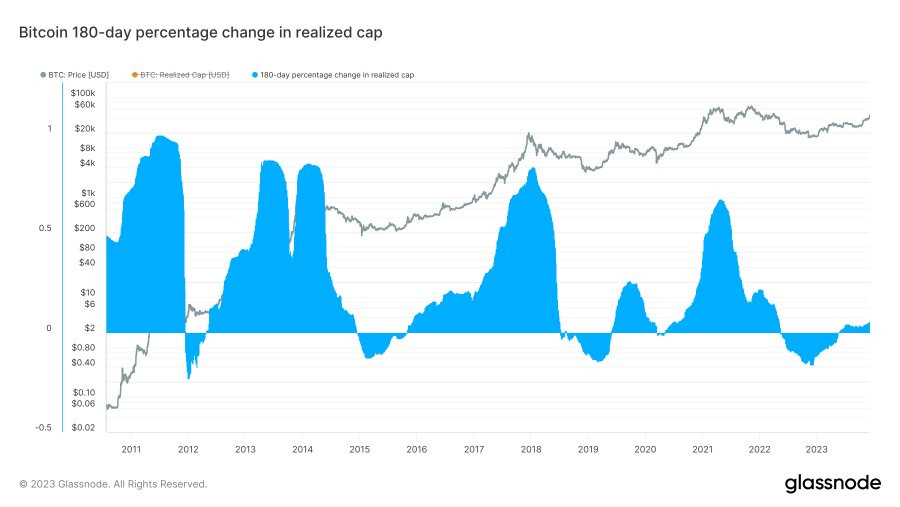

Bitcoin's Realized Cap Signals Net Capital Inflow

"The realized cap of Bitcoin, which measures the network's capitalization based on the timing of the last movements of coins, serves as an indicator of the net capital inflows or outflows.

Notably, in May, the 180-day change in Bitcoin's realized cap turned positive, highlighting a trend of net inflows into the network."

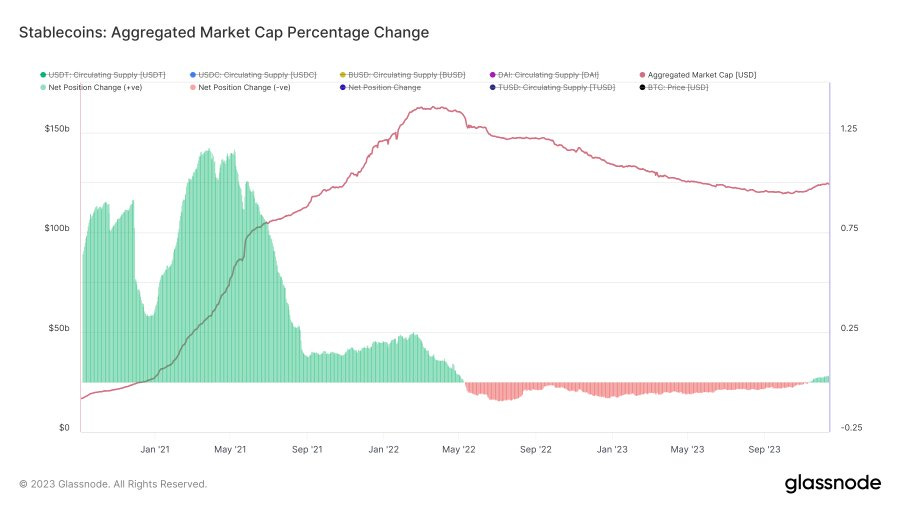

Market Indicates Capital Inflows: Positive Shift In Stablecoin Market Cap

Recent trends in the cryptocurrency market suggest a positive shift in capital movements.

This is evidenced by the 90-day percentage change in the total market capitalization of stablecoins, which has turned positive for the first time in one and a half years, signaling an increase in capital inflows.

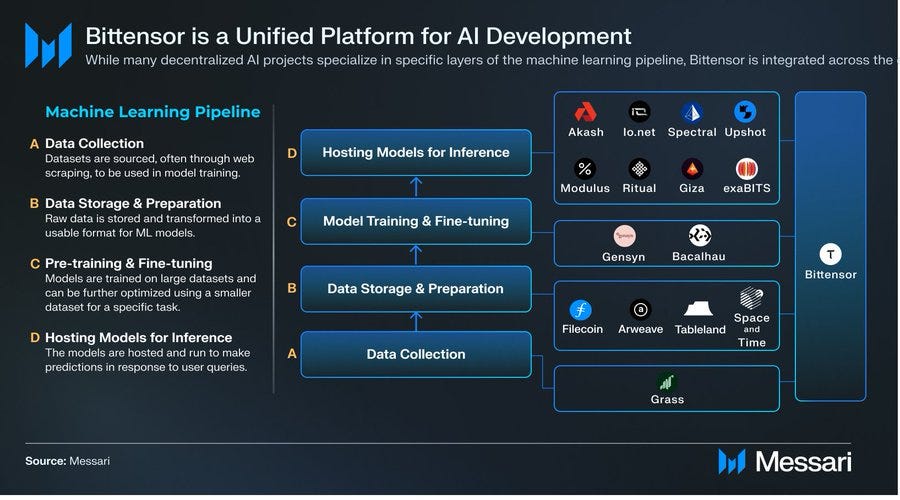

The Rise Of Decentralized AI:

The crypto space is witnessing the rise of decentralized AI (DeAI), a fusion of AI technology and blockchain.

This integration is opening up new possibilities for collaboration and innovative use cases, particularly in addressing societal challenges through AI and blockchain synergies.

A notable example is Bittensor (TAO), a leader in decentralized AI development, recently featured in a Messari research report.

Beyond the primary applications, decentralized AI presents a variety of intriguing use cases, such as AI agents. VC firm a16z, with assets under management of $35 billion, offers valuable perspectives on the potential synergies between AI and blockchain technology

Here are some more institutional resources to learn more:

Curious To How I Am Playing The AI Vertical?

Explore my premium edition, where I share insights into my personal investments in AI-related crypto. Notably, the largest position in my portfolio soaring by over 800% in just the past 2 months.

Don't miss out on staying ahead at the intersection of blockchain and AI!

My Crypto Portfolio:

Here’ my core crypto investments, listed in order of largest to smallest holdings, reflecting their weight in my portfolio.

Keep reading with a 7-day free trial

Subscribe to Markets, Distilled to keep reading this post and get 7 days of free access to the full post archives.