Welcome to the 57th edition of "Crypto, Distilled," your 5-minute biweekly edge in the crypto market.

Please note that all content is for informational purposes only and should not be considered financial advice. For full details, see the disclaimer.

Market Overview:

Over the past week, both BTC and ETH experienced modest increases, with ETH slightly outperforming BTC.

Key performers were ETH-related projects, particularly Lido Finance (LDO) and Arbitrum (ARB), increasing by 34% and 15.5% respectively.

BTC Bull Market Support Band (BMSB) Analysis:

The BTC BMSB is traditionally a support zone during BTC bull runs. BTC’s price is presently higher than the BMSB, which sits at approximately $36,000.

Composition: The BMSB lies between the 20-week simple moving average and the 21-week exponential moving average.

Historical Role: In the 2017 bull run and late 2020, Bitcoin frequently corrected to the BMSB, which acted as support.

Future Importance: The BMSB could be a critical area to monitor for potential market corrections, especially post-ETF decision.

Potential Local Top for Bitcoin (BTC)?

Avenger, a noted crypto trader, suggests that Bitcoin (BTC) might have hit its intermediate-term peak amidst the climax of ETF speculation.

In my opinion, a post-ETF launch cooldown in the short-term, followed by a medium-term rally driven by ETF inflows and heavy ETF marketing seems plausible.

ETHBTC Reversal Soon?

Cole Garner suggests it's premature to declare an ETHBTC reversal, but current patterns resemble early stages of past reversals, particularly noted with high volume.

In my opinion, a significant ETH/BTC reversal might occur if BTC experiences a substantial pullback (10% +).

Current market liquidity is low, yet a shift in investor focus to Spot ETF ETH, especially with an impending BTC Spot ETF decision, could make this scenario plausible.

News Highlights:

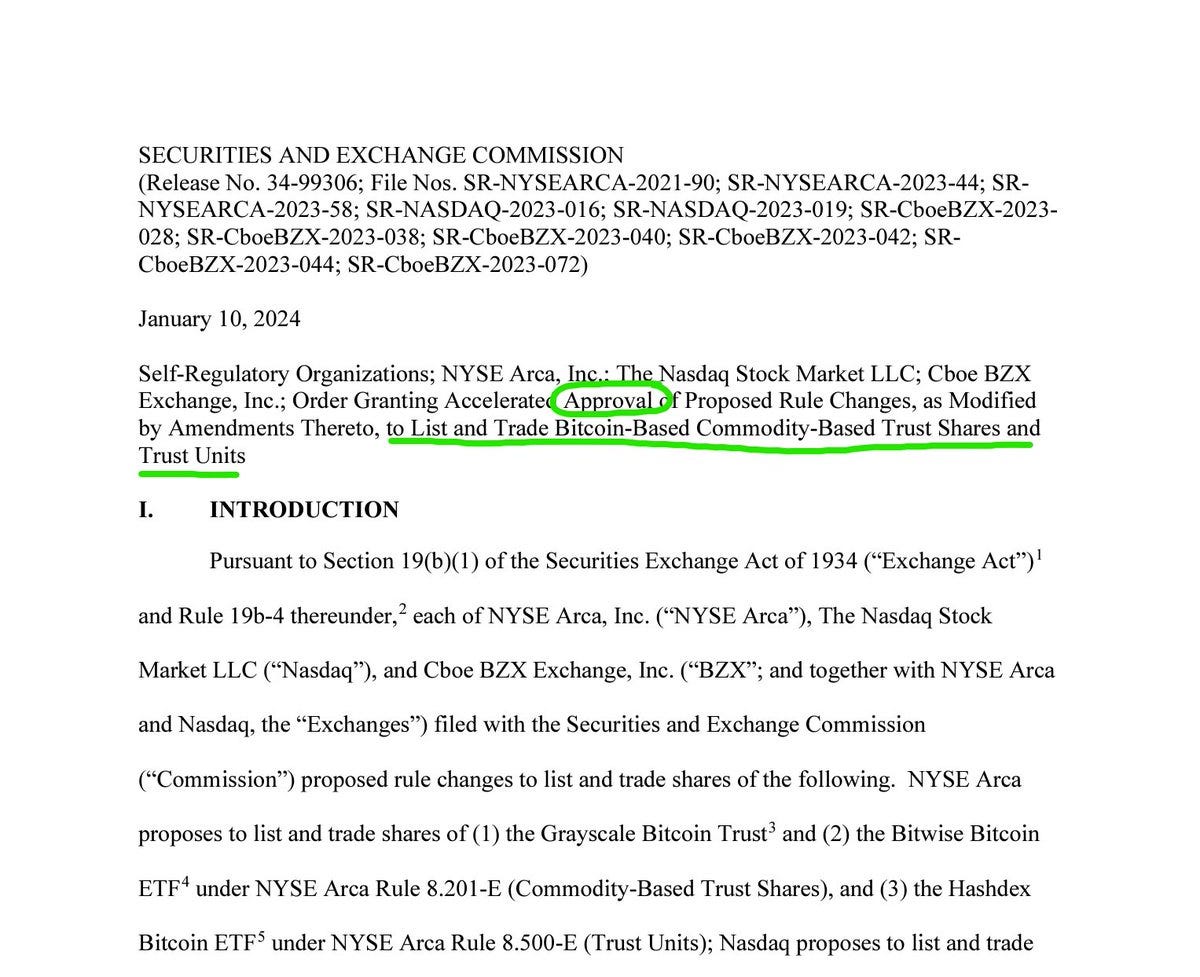

SEC Greenlights First Bitcoin Spot ETF:

The Securities and Exchange Commission (SEC) has at last approved the first Bitcoin Spot ETF, marking a significant milestone in the cryptocurrency landscape.

This approval was officially announced on the SEC website.

Bitcoin ETF Fee War Landscape: Overview

The competition among Bitcoin ETF providers is intensifying, particularly in the aspect of fee reductions.

BlackRock's Aggressive Strategy: BlackRock has significantly reduced its spot Bitcoin ETF fee to 0.25%, and even more to 0.12% for the initial $5 billion.

ARK's Response: In reaction to the market dynamics, ARK has also reduced its ETF fees to 0.21%.

Current Lowest Fee: Presently, Bitwise holds the position for the lowest fee at 0.20%.

Source - Bloomberg

Fake Bitcoin ETF Approval Tweet Leads To $90M In Liquidations:

Earlier this week, a false tweet claiming SEC approval of a Bitcoin ETF caused significant market volatility, leading to nearly $90 million in Bitcoin liquidations.

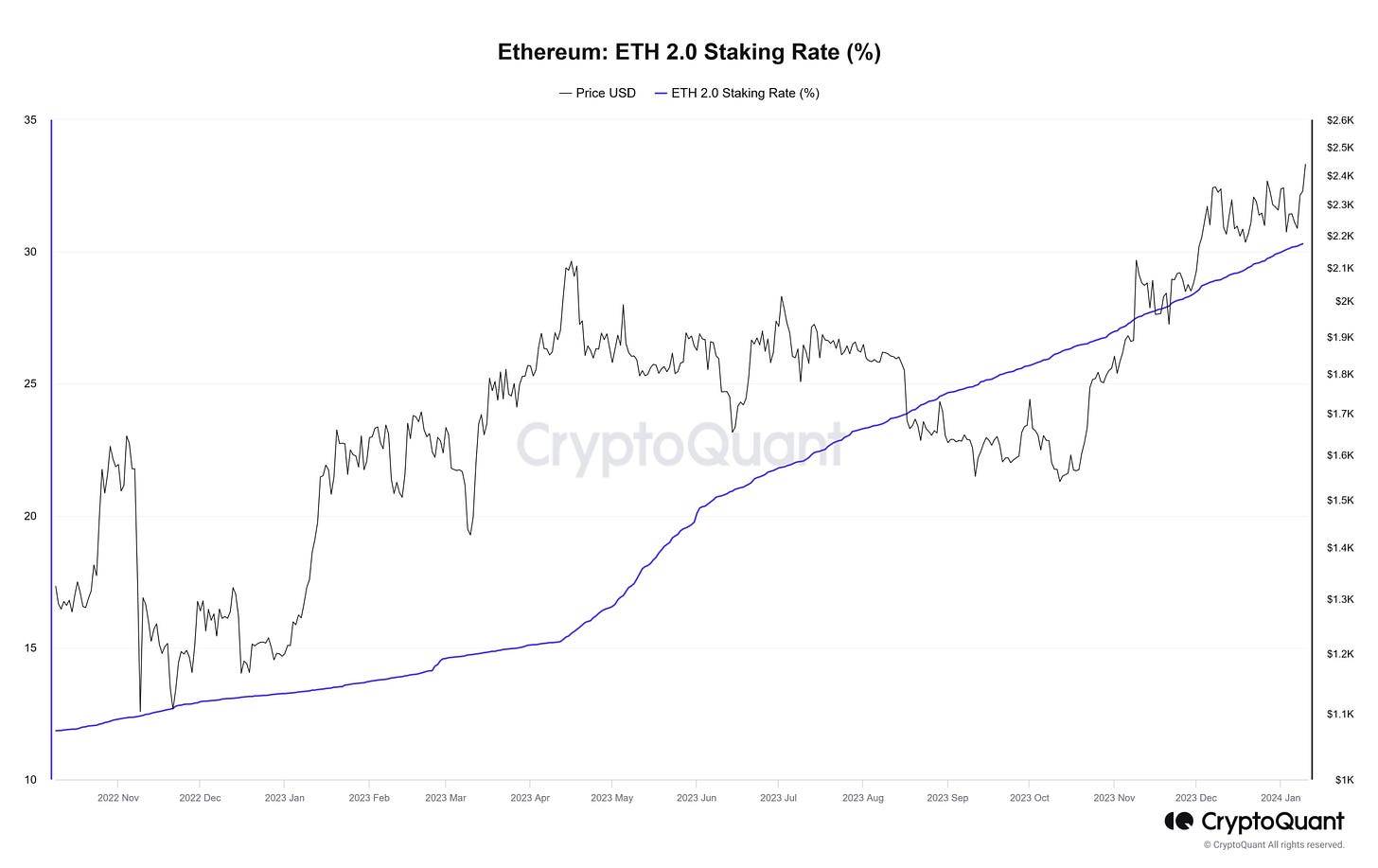

Record-Breaking Staking: 30% of Ethereum Now Staked

Ethereum's staking ratio has soared to all time highs, with an impressive 30% of all ETH, equivalent to over $85 billion, now staked.

Source - Crypto Quant

Key Market Trends:

Bitcoin ETF vs. Gold ETF Price Action Comparison:

The 2005 launch of the Gold Spot ETF offers a useful comparison for the anticipated Bitcoin (BTC) Spot ETF.

Despite differing macroeconomic conditions, an analysis of both assets’ price behaviors is intriguing. Here's a summary of gold’s performance:

Two consecutive weeks of growth.

A sharp downturn.

A phase of re-accumulation.

A significant bull market after one year.

Crypto analyst Marco Johanning outlines a hypothetical scenario for BTC, mirroring gold's trajectory:

Considering the faster pace at which BTC moves compared to gold, it’s plausible to expect a similar pattern for BTC, albeit within a shorter timeframe.

BTC Cycle Analysis: A Promising Long-Term Outlook

A cycle-by-cycle analysis of Bitcoin, independent of ETF decisions or short-term price fluctuations, reveals a very promising trend.

Since its creation, Bitcoin has gone through four complete four-year cycles.

The present cycle, starting in 2022, shows significant potential for returns and still has ample time to develop. When in doubt, zoom out.

Source - Glassnode

Smart Money Is Overwhelming Buying ETH:

Nansen, a leading crypto intelligence platform, reports a significant uptick in ETH investments by 'Smart Money'.

Smart Money is used by Nansen to describe entities who demonstrate well-informed, and trend-anticipating trading or investment behaviors.

Further reinforcing this trend, data from IntoTheBlock shows a steep increase in ETH holdings by crypto whales despite stagnant prices.

IntoTheBlock classifies as Whales all addresses that hold over 1% of a crypto-asset's circulating supply.

Stablecoin Supply Rebounds: Is the Market Heading For A Bullish 2024?

For the majority of 2022 and 2023, the aggregate stablecoin circulating supply faced a significant decline.

However, recent developments, particularly the steady increase in USDT circulation, point to a potential bullish trend for the stablecoin market in the new year.

Source - Glassnode

Weekly Insight: AI Agents - The Next Big Crypto Trend?

The imminent launch of OpenAI's GPT Store, set to be unveiled next week, could be a massive catalyst for the intersection of AI and the crypto sphere.

The GPT Store offers a platform for users to create, market, and exchange personalized AI agents, all built upon the foundation of ChatGPT.

These AI agents can be finely tuned to serve a multitude of specific purposes, ranging from explaining memes to expertly helping users navigate intricate negotiations.

Unlocking Efficiency: Crypto Payment Rails For AI Agents

Sophisticated AI agents will require access to capital, however, conventional banking systems are sluggish and inefficient.

Crypto payment rails offer a streamlined solution.

Here, agents can autonomously manage wallets, execute transactions, and interact with other agents in a transparent and decentralized manner.

Scott Dykstra eloquently illustrates this concept:

AI agents act as the driving force in the AI economy, functioning like versatile tools that assemble AI models and computational resources seamlessly.

They play a crucial role as the final touchpoint for users, delivering tasks and sitting at the forefront of service delivery.

Imagine a world where AI agents are secured by blockchain technology (e.g. Solana), and empowered by off-chain AI (e.g. Chat GPT-4.5).

The Future Of Blockchain: Humans & AI Agents

The first billion users of blockchain will likely be humans and agents.

Nansen predicts a proliferation of AI agents within the blockchain space.

Messari believes AI agents will use crypto infrastructure for access to digital resources (storage, compute, bandwidth).

These agents have versatile applications, ranging from portfolio management to security and audits — representing a significant leap forward in automation.

In the words of Mason Nystrom, the potential of agents in this realm is truly remarkable:

If you're intrigued by the potential of the AI agent narrative, which could be the next major trend, I invite you to subscribe to my newsletter.

My largest portfolio investment, an AI agent-related project, has grown over 6x in two months and is now on a dip, presenting a potential opportunity.

My Crypto Portfolio:

Here’s my core crypto investments, listed in order of largest to smallest holdings, reflecting their weight in my portfolio.

Keep reading with a 7-day free trial

Subscribe to Markets, Distilled to keep reading this post and get 7 days of free access to the full post archives.