Welcome to the 60th edition of "Crypto, Distilled," your 5-minute biweekly edge in the crypto market.

Please note that all content is for informational purposes only and should not be considered financial advice. For full details, see the disclaimer.

Market Overview:

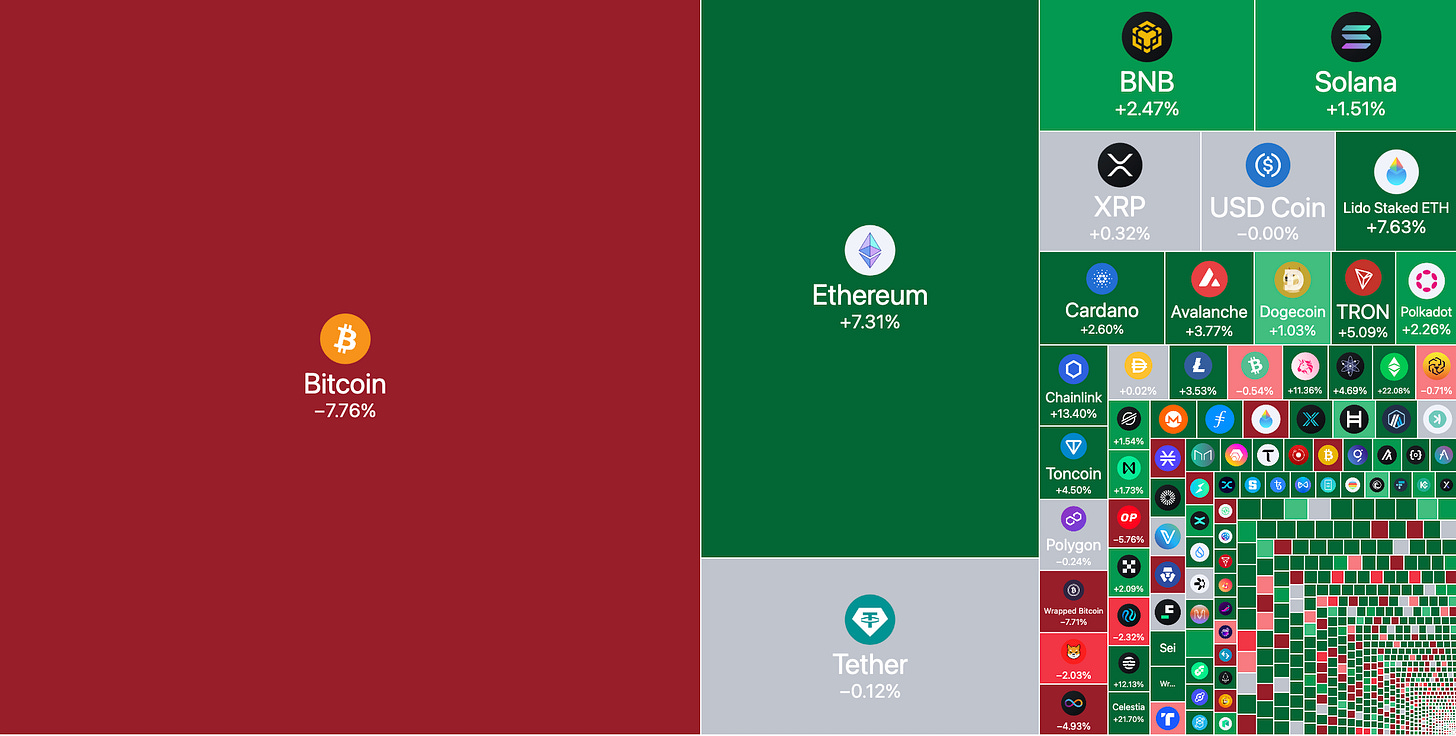

Over the past week, Bitcoin (BTC) fell by 8%, while major altcoins like Ethereum (ETH), up over 7%, gained.

Macro Outlook: Persistent Global Liquidity

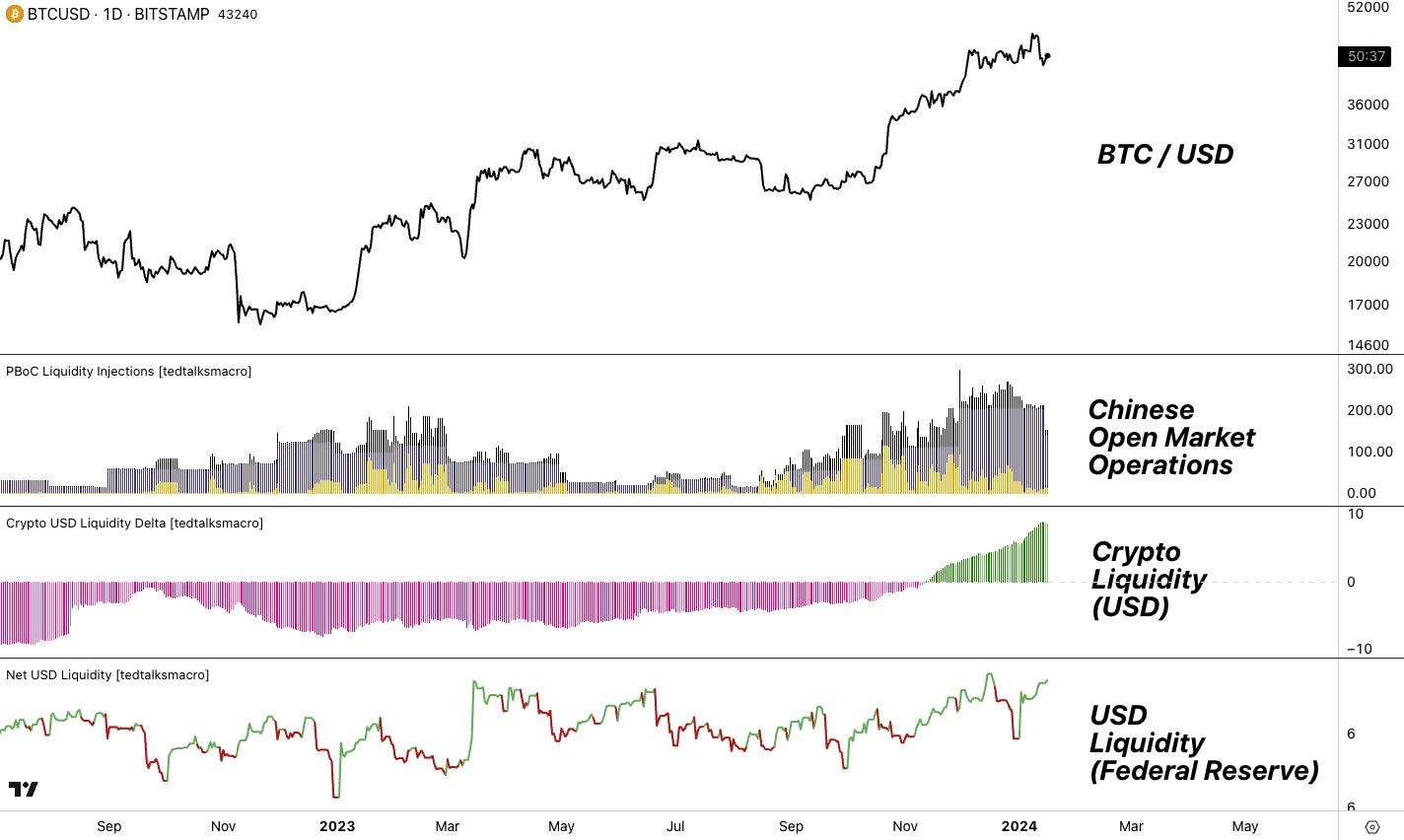

Tedtalksmacro notes that despite monetary tightening, there will be no recession or rate cuts this year. Instead, central banks worldwide continue to inject 'silent liquidity'.

The global economy remains reliant on deficits and easy money, maintaining higher liquidity levels than before the COVID era.

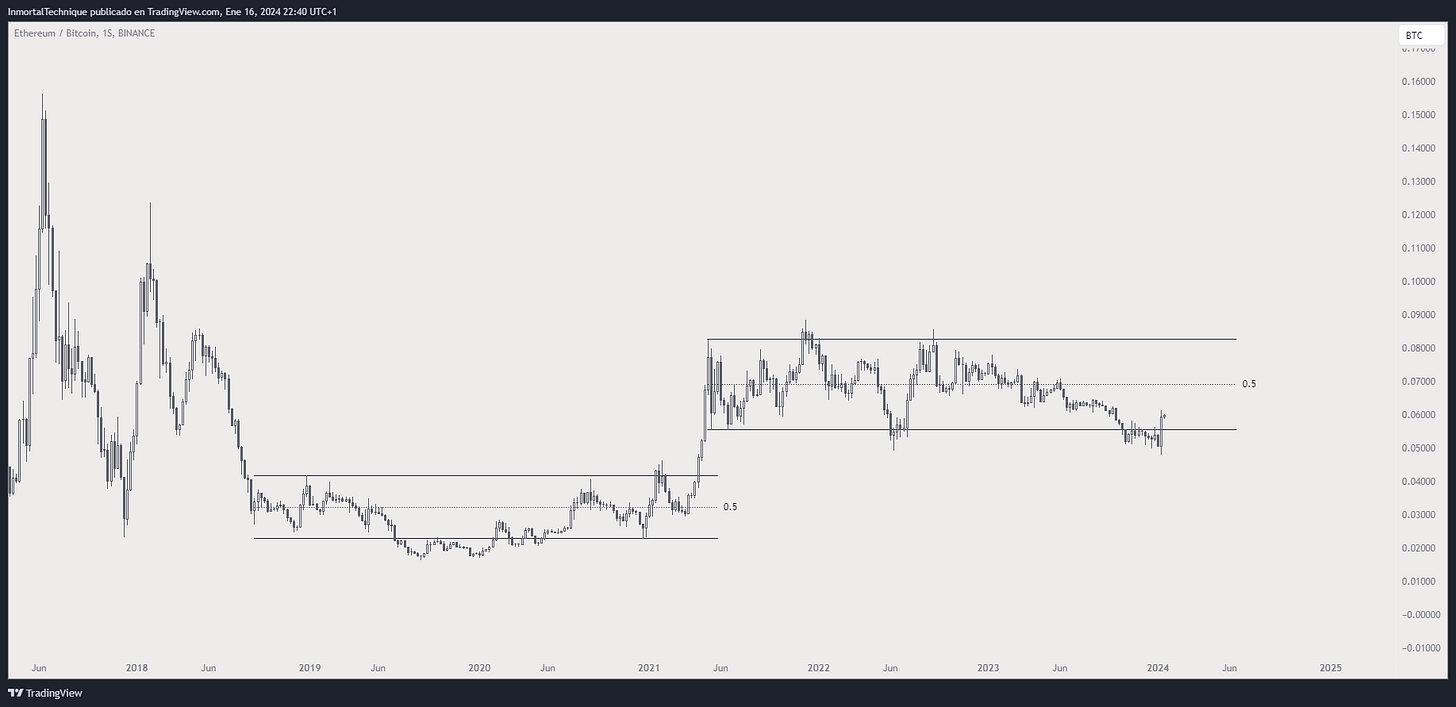

Potential ETH/BTC Breakout In Q1 2024?

Trader Inmortal highlights the historical pattern of ETH's price movements, noting that in the last cycle, ETH's accumulation phase lasted 959 days before a major surge.

Currently, this cycle's accumulation has extended to 973 days.

Considering the anticipated launch of the ETH ETF following the BTC-ETF debut, I speculate there’s a strong possibility of a imminent multi-week surge in ETH/BTC.

Altcoins' Potential Rally Amid BTC Weakness:

Altcoin Psycho observes a historical trend where altcoins, exemplified by ETH and SOL, surged when BTC’s dominance declined. This pattern was evident in 2017.

The current altcoin uptrend indicates that a decline in BTC dominance in 2024, mirroring 2017 patterns, may trigger a substantial altcoin rally.

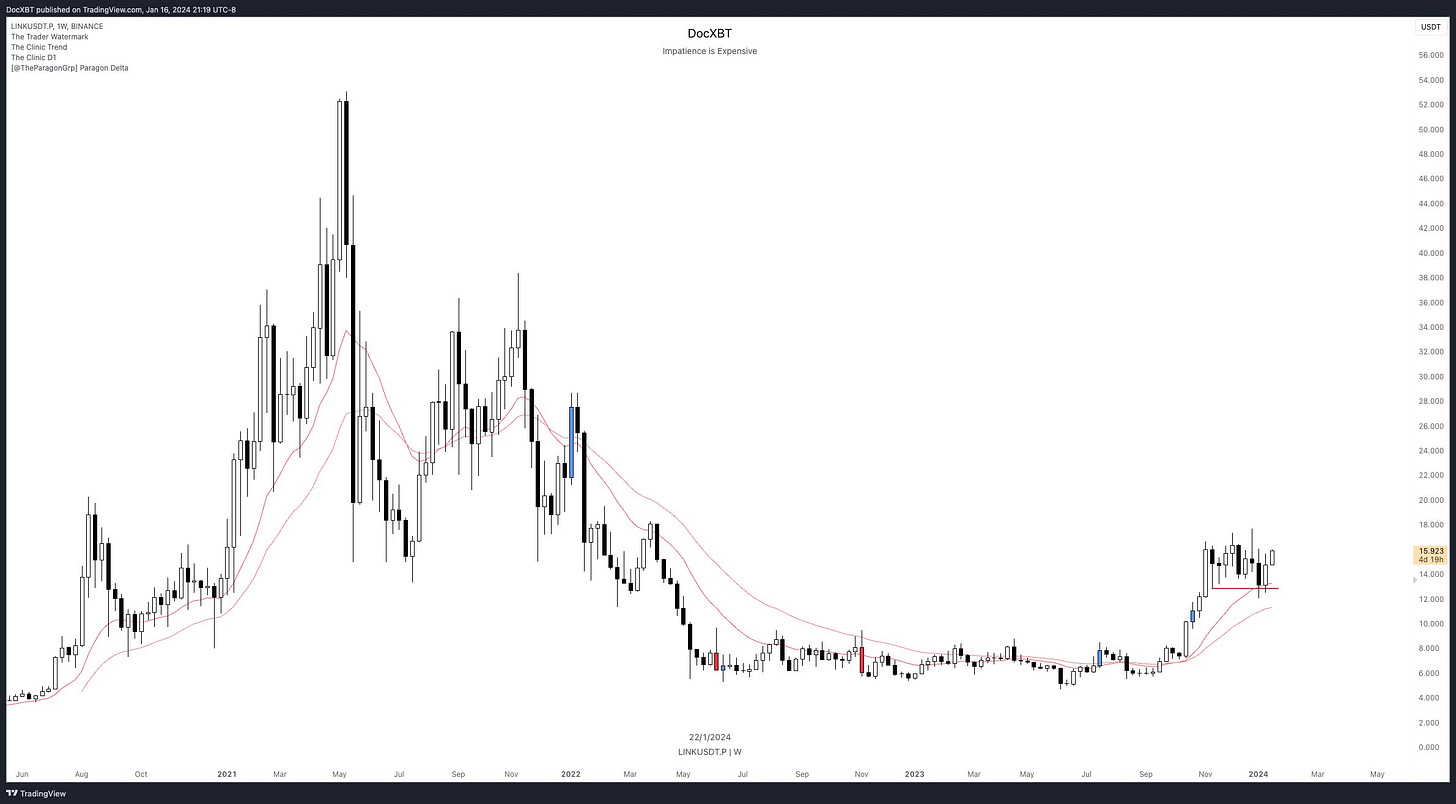

Chainlink (LINK) Outlook: Bullish Weekly Trend

Trader docXBT, on X (formerly Twitter), identifies Chainlink's (LINK) current weekly price momentum as a strong bullish setup.

Larry Fink's endorsement of tokenization adds significant support to Chainlink's bullish outlook, considering its leading role in the oracle sector.

The necessity of real-time, accurate data for tokenized assets underscores Chainlink's critical importance in this evolving trend.

News Highlights:

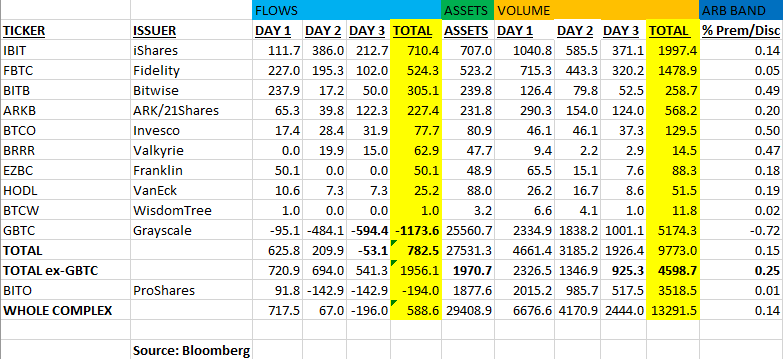

Strong Initial Performance Of Spot BTC ETFs:

Eric Balchunas reports that on the third day since their launch, the net flows into Spot BTC ETFs have reached over $750 million.

The new ETFs, termed 'The Newborn Nine', have accumulated $2 billion in assets under management and generated $4.5 billion in trading volume, indicating a successful start with stable premium percentages.

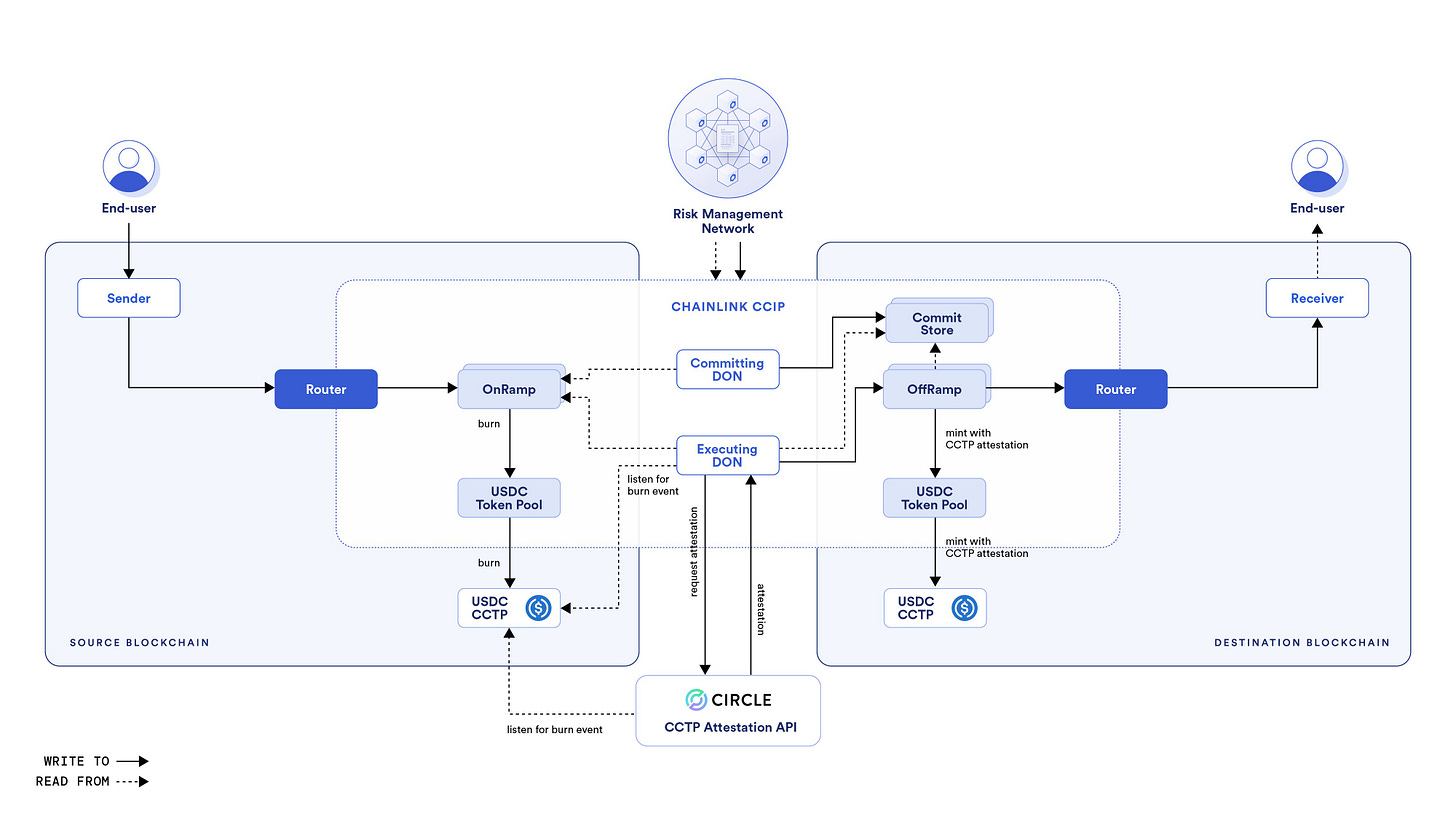

Chainlink & Circle Partner For Streamlined USDC Transfers:

Chainlink's Cross-Chain Interoperability Protocol (CCIP) has integrated with Circle's Cross-Chain Transfer Protocol (CCTP) to facilitate cross-chain USDC transactions.

This collaboration allows for the seamless transfer of USDC across different blockchains, with Chainlink ensuring secure and reliable execution.

Source - Chainlink

Key Market Trends:

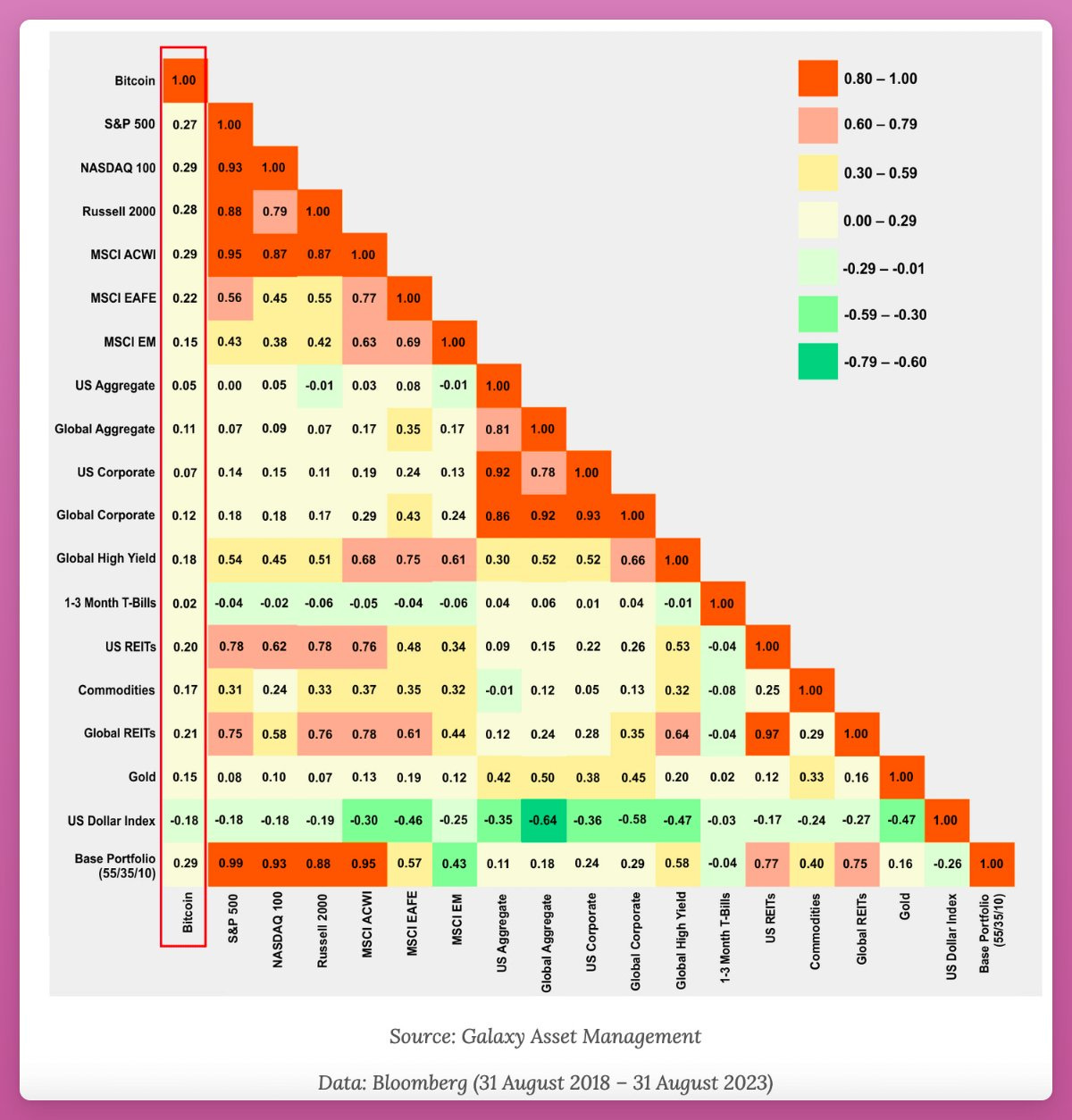

BTC's Low Correlation With Traditional Finance Assets (2018-2023):

Between August 2018 and August 2023, BTC consistently showed low correlation with traditional finance (TradFi) assets, contrary to widespread media narratives.

The provided table, particularly the far-left column, illustrates BTC's uncorrelated behavior with TradFi assets.

Source - Arthur Hayes

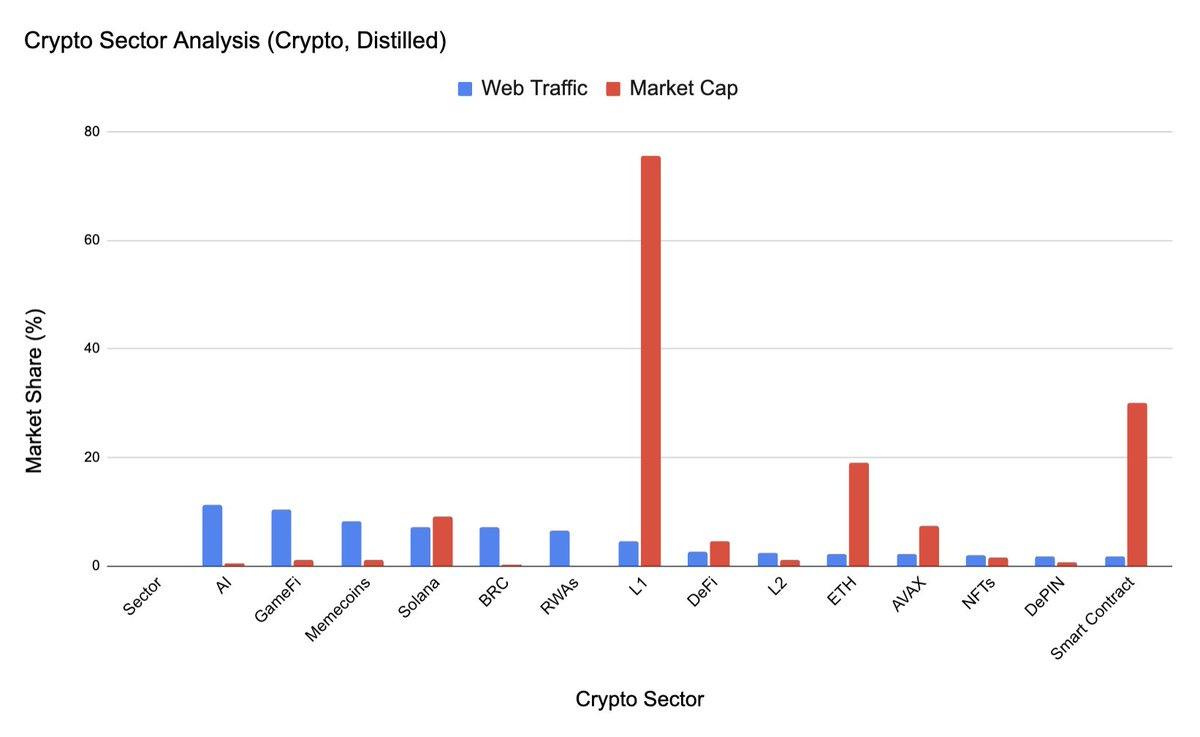

Crypto Sectors: Web Traffic Versus Market Cap Disparities

There's a striking disparity between web traffic and market capitalization (MC) in various crypto sectors.

AI and GameFi led 2023's web traffic on CoinGecko, but their MCs remain tiny. I expect dramatic changes in sector MCs as key narratives evolve in 2024.

Arbitrum Ecosystem Leads In Crypto Performance:

This month, the Arbitrum (ARB) ecosystem has excelled above all others in the crypto space, with GMX emerging as a particularly strong performer within the ecosystem.

Source - Crypto Koryo

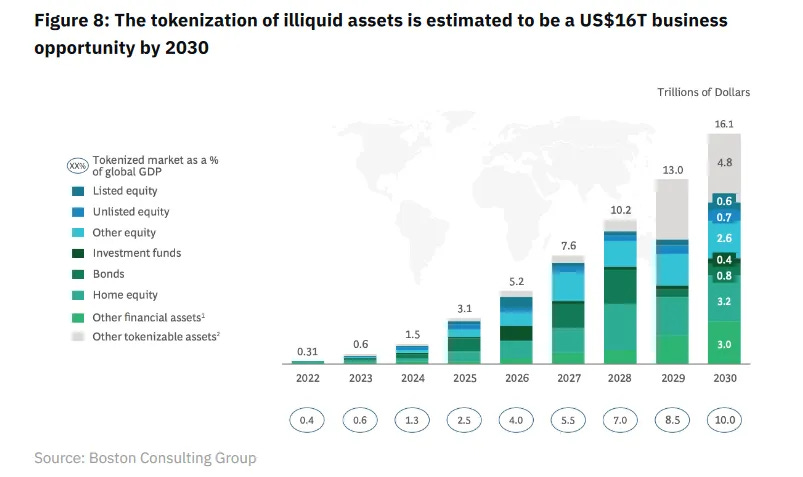

Real-World Assets (RWA) On Blockchain: Market Potential

Real-World Assets (RWA) like real estate, commodities, and bonds are becoming accessible on the blockchain.

As of January 17th, the Total Value Locked (TVL) in RWAs is around $5.26 billion, according to Defillama. Binance Research estimates the RWA market could reach $16 trillion by 2030.

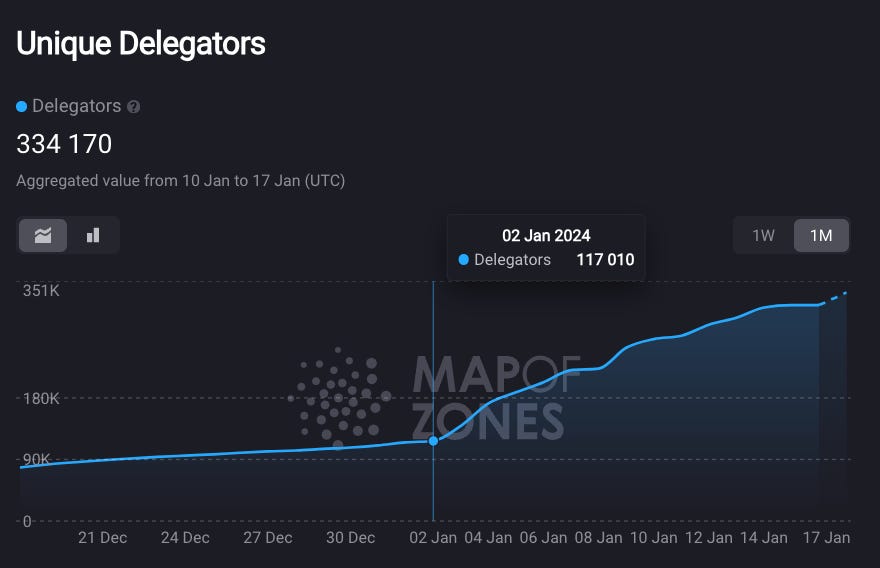

Surge In Unique Celestia (TIA) Staking Wallets:

Celestia, a modular data availability network facilitating scalable blockchain creation, is witnessing a significant increase in engagement.

The number of unique wallets staking TIA, Celestia's native currency, has tripled in the last two weeks, rising from 117,000 to 334,000.

Source - 0xJayeg

Weekly Insights:

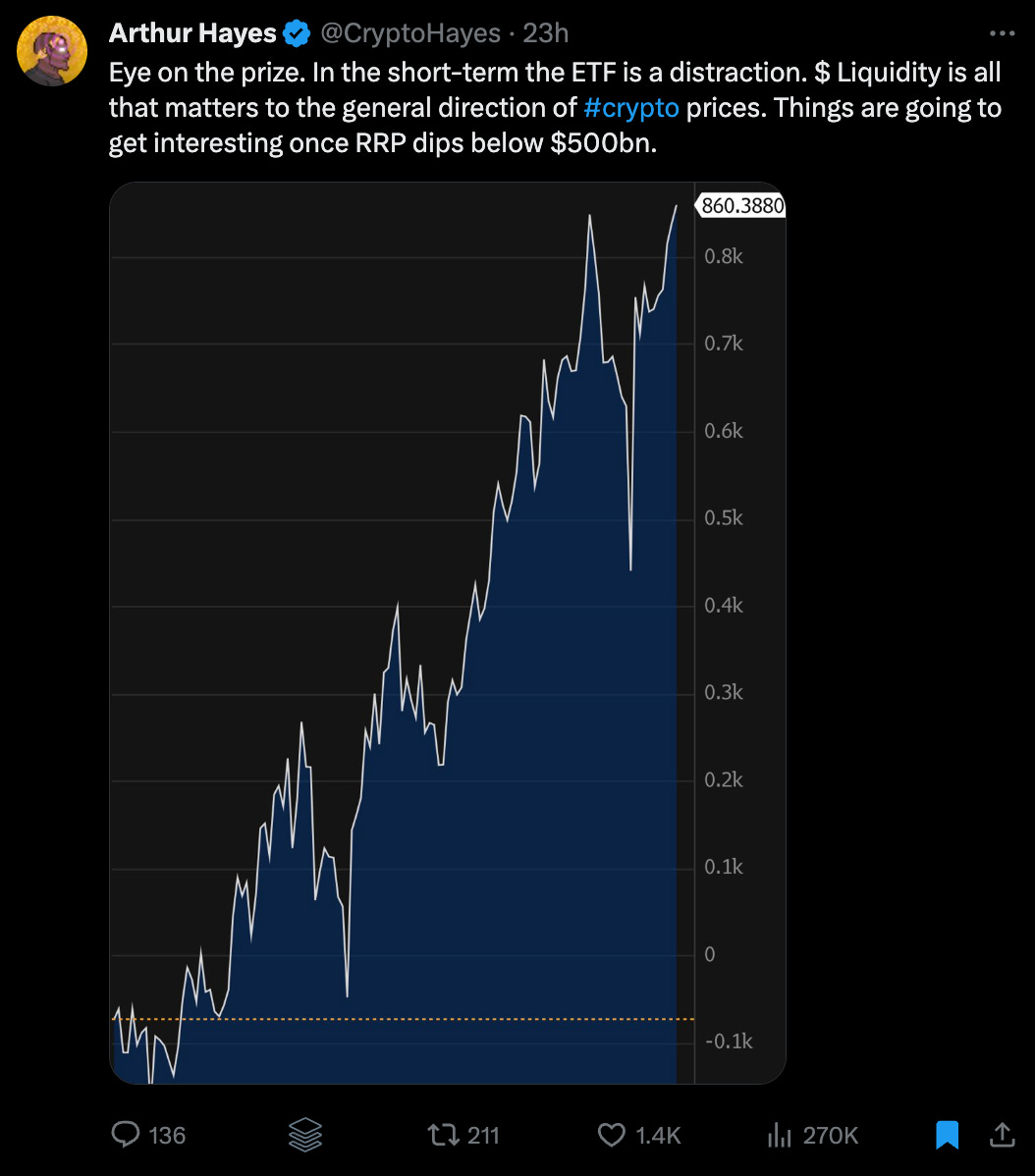

Arthur Hayes On ETF Impact: A Short-Term Distraction

Arthur Hayes, a renowned figure in the crypto industry, views the BTC Spot ETF as a temporary distraction.

He emphasizes that, in the medium to long term, the only significant factor for cryptocurrencies is liquidity, downplaying the ETF's immediate impact.

My Crypto Portfolio:

Here’s my core crypto investments, listed in order of largest to smallest holdings, reflecting their weight in my portfolio.

Keep reading with a 7-day free trial

Subscribe to Crypto, Distilled to keep reading this post and get 7 days of free access to the full post archives.