Welcome to the 61st edition of "Crypto, Distilled," your 5-minute biweekly edge in the crypto market.

Please note that all content is for informational purposes only and should not be considered financial advice. For full details, see the disclaimer.

Market Overview:

This week, the crypto market saw steep declines: Bitcoin fell over 10%, Ethereum over 5%, and most altcoins suffered heavy losses.

Bitcoin Nears Key Support Threshold:

Benjamin Cowen, a notable crypto analyst, notes BTC’s approach to the crucial bull market support band, a pattern observed in Jan/Feb of its halving years.

In previous cycles (2012, 2016), Bitcoin maintained this support, but it broke in 2020.

The bull market support band combines the 20-week simple moving average and the 20-week exponential moving average.

2025 Crypto Liquidity Surge Predicted:

Altcoin values often mirror crypto market liquidity. Macro analyst Tedtalksmacro foresees a record high in USD liquidity in the crypto space by 2025.

Altcoins are expected to lead these inflows this year, following recent patterns. Since last October, the crypto market has seen an influx of about 10 billion USD.

News Highlights:

2023 Crypto Crime: $24B in Illicit Transactions:

Chainalysis, a blockchain intelligence firm, reports that illicit addresses received over $24 billion in cryptocurrency in 2023, constituting 0.34% of total transaction volume.

Source - Coindesk

This figure, as per Coindesk, marks a nearly 40% decrease from 2022, though Chainalysis emphasizes that these numbers are provisional.

Franklin Templeton Optimistic On Ethereum And Other L1 Networks

Franklin Templeton, a prominent BTC ETF provider managing $1.5B, remains bullish on Ethereum despite its challenges.

The firm cites Ethereum's upcoming EIP 4844, alternative data availability, community efforts, and re-staking mechanisms as key growth drivers.

The firm's optimism extends beyond Bitcoin, Ethereum, and Solana to other layer 1 networks, with plans to support and nurture their development.

Additionally, Franklin Templeton recognizes the potential of Ordinals and L2 BTC protocols in enhancing BTC’s security and its role as a Store of Value.

Key Market Trends:

'Value Days Destroyed' Indicator Suggests Early Frothiness In Cycle

The 'Value Days Destroyed Multiple,' a notable on-chain metric, indicates elevated activity levels at this early cycle stage, signaling a need for Bitcoin's price to stabilize.

According to Look Into Bitcoin, this metric compares coin days destroyed against historical norms, revealing spikes in activity that frequently coincide with market tops.

Bitcoin's Rise Contrasts With Declining Crypto VC Investments

While Bitcoin has seen a 160% price surge, crypto venture capital investments are consistently reaching new lows.

This trend may suggest a shift in investor preference towards liquid investments for alpha generation over traditional venture capital routes.

Source - Galaxy Research

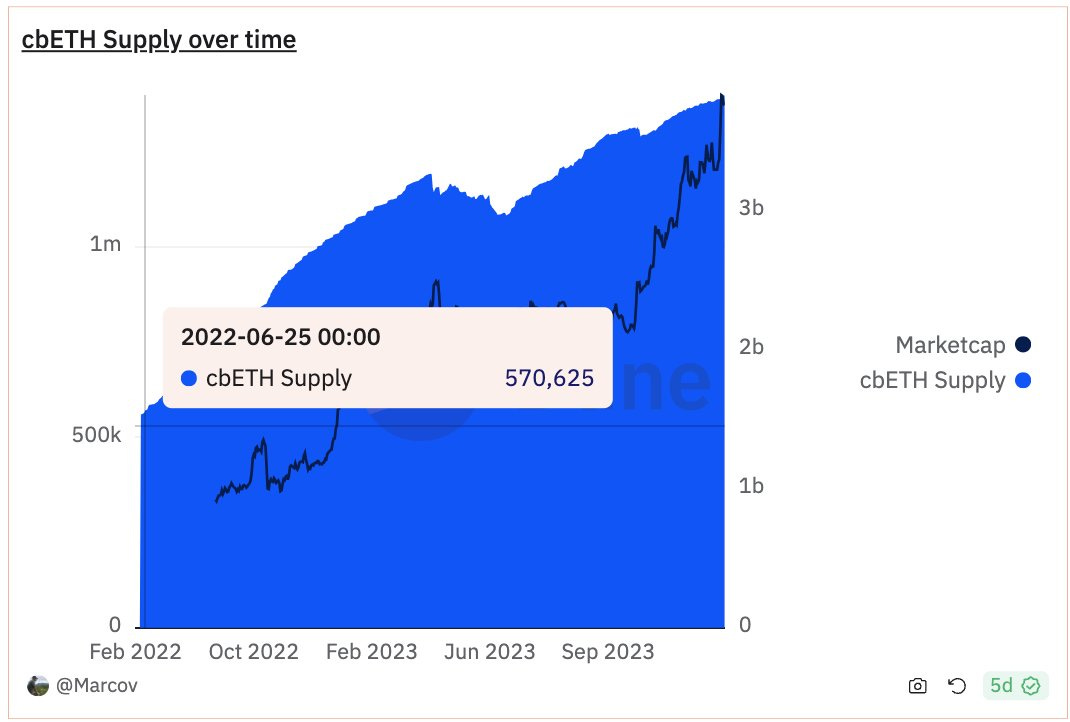

Coinbase Staked ETH Grows Amid High Fees:

Analyst Jay from X (formerly Twitter) observes that despite a minor decline after enabling withdrawals, Coinbase's staked ETH has grown significantly, increasing by +143% since the program's inception.

Notably, Coinbase charges a 25% fee on this service. With increasing interest from retail and institutional investors, the supply of Coinbase's staked ETH is likely to continue expanding.

Are Crypto Miners Profit-Taking Ahead of Bitcoin Halving?

As the Bitcoin halving nears, miners typically start selling from their reserves to secure profits, a trend that recent charts suggest is in motion.

Source - CryptoQuant

With the halving six months away, reducing their reward share, miners seek strategies to maintain profitability in a competitive landscape.

"Every halving forces out miners not operating at peak efficiency," notes William Szamosszegi, CEO of Sazmining.

Binance Spotlights Solana's Role In DePINs Evolution:

Binance Research highlights Solana as a pivotal platform for decentralized physical infrastructure networks (DePINs).

Solana's expanding ecosystem, including projects like Helium (HNT), Render Network (RNDR, and Hivemapper (HONEY), underscores its importance.

Aave Eyes Solana Expansion Via Neon EVM

Aave, a leading lending protocol on Ethereum, is considering a proposal to deploy its protocol on Solana using Neon EVM.

This move to Aave v3 would allow Aave to access the Solana DeFi market, significantly impacting the decentralized finance ecosystem.

Weekly Insights:

Navigating Market Dips With A Long-Term View:

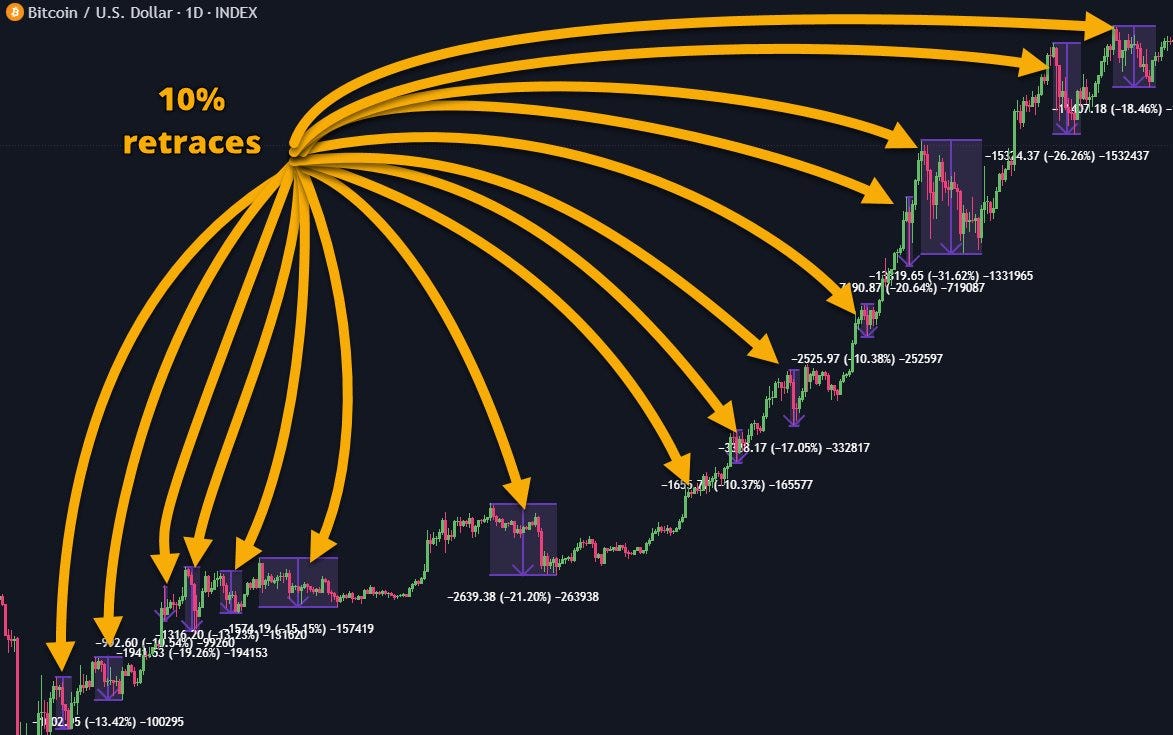

Market dips often trigger panic selling instincts, as illustrated by the numerous instances when Bitcoin plunged by 10% or more in the last bull run.

A long-term investment thesis is crucial during such volatility, helping to navigate the market fluctuations and manage risks effectively.

Source - Lady Of Crypto

Project Saturation Calls for Discerning Decisions:

On-chain trader Res underscores the current saturation in the crypto market, marked by an influx of new projects, emissions and copycats across chains.

This scenario presents an opportune moment to critically evaluate your portfolio, determining which assets are worth retaining or acquiring, and which ones to let go.

My Crypto Portfolio:

Here’s my core crypto investments, listed in order of largest to smallest holdings, reflecting their weight in my portfolio.

Keep reading with a 7-day free trial

Subscribe to Markets, Distilled to keep reading this post and get 7 days of free access to the full post archives.