Welcome to the 67th edition of "Crypto, Distilled," your 5-minute biweekly edge in the crypto market.

Our content is entirely independent, free from paid promotions, delivering you valuable, unbiased research at the market’s edge.

Please note that all content is for informational purposes only and should not be considered financial advice. For full details, see the disclaimer.

1. Market Overview:

A. Weekly Crypto Market Update: Bitcoin And Altcoins Rally

This week, the crypto market saw notable relief, with Bitcoin rising 8%. Major altcoins Solana and Avalanche outperformed, increasing by 16% and 20% respectively.

Source - Trading View

B. Bob Loukas On Short-Term Market Chop:

Esteemed crypto investor, Bob Loukas, addresses the current market, predicting more chop as we head into Q2, despite the recent relief rally.

While he observes robust inflows and buy pressure from Tether, he also highlights the offsetting impact of considerable sell-offs by ETF front-runners from last year.

C. Altcoin Trends And Halving Impact Forecast:

Ellio Trades analyzes altcoin patterns, suggesting a potential decline before the April 2024 halving, reminiscent of the pre-2020 halving dip.

However, he highlights the importance of focusing on long-term growth, driven by rising global liquidity, ETF inflows, and a positive regulatory outlook.

Source - Ellio Trades

D: Sustained Crypto Market Growth

Glass Node's analysis reveals a 140% return on investment (ROI) in the crypto market since 2022, indicating robust growth potential.

Despite the trend of diminishing returns, there's significant potential for further expansion into late 2024 and possibly 2025.

Source - GlassNode

2. Technical Analysis:

A. Chainlink’s (LINK) Upward Momentum:

LINK has moved beyond a year-long accumulation phase and is now coiling at a higher range on the weekly chart, indicating readiness for potential growth.

This potential growth could be driven by the increasing trend towards 'tokenization’, a narrative previously advocated by Larry Fink.

Source - Byzantine General

B. Solana Is Trading At A Consistent Spot Premium:

Post-Jupiter airdrop, Solana sees a significant market surge, trading at a spot premium for the first time since October 2023.

This trend, where SOL tokens are valued higher than their derivative contracts, often signals a bullish market outlook.

Source - Tedtalksmacro

C. Bitcoin Aligns With Safe-Haven Narrative Assets Post-ETF:

Following the rise of the BTC ETF narrative in late 2023, which positioned Bitcoin as a safe-haven asset, its 90-day correlation with gold has become positive.

This marks a significant perception shift, recognizing Bitcoin as a stable investment comparable to traditional safe havens such as gold.

Source - Omkar Goldbole

3. News Highlights:

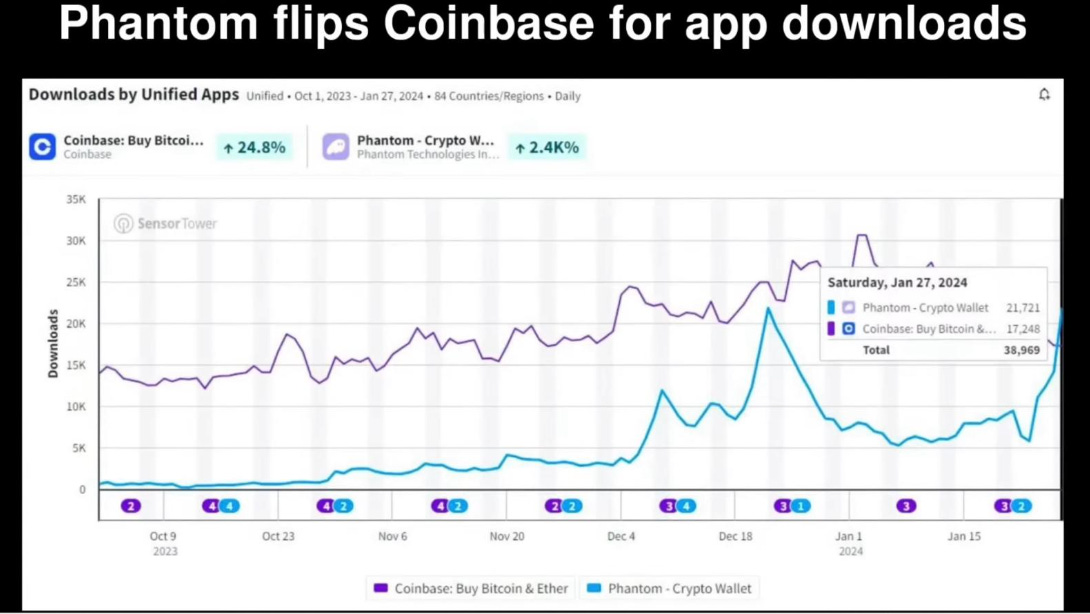

A. Phantom Wallet Surpasses Coinbase in Downloads

Recent data shows Solana's Phantom wallet downloads exceeding those of Coinbase, highlighting a notable shift towards Solana's adoption in the DeFi sector.

Source - InvestAnswers

B. Swift Uptake Of Spot Bitcoin ETFs:

Spot Bitcoin ETFs have quickly captured 3.3% of the total Bitcoin supply in under a month since launch.

Swan Media's analysis also shows that ETFs, funds, companies, and governments hold just about 10% of all Bitcoin, suggesting most BTC is in private hands or lost.

Source - Watch Guru

4. On-Chain Analysis:

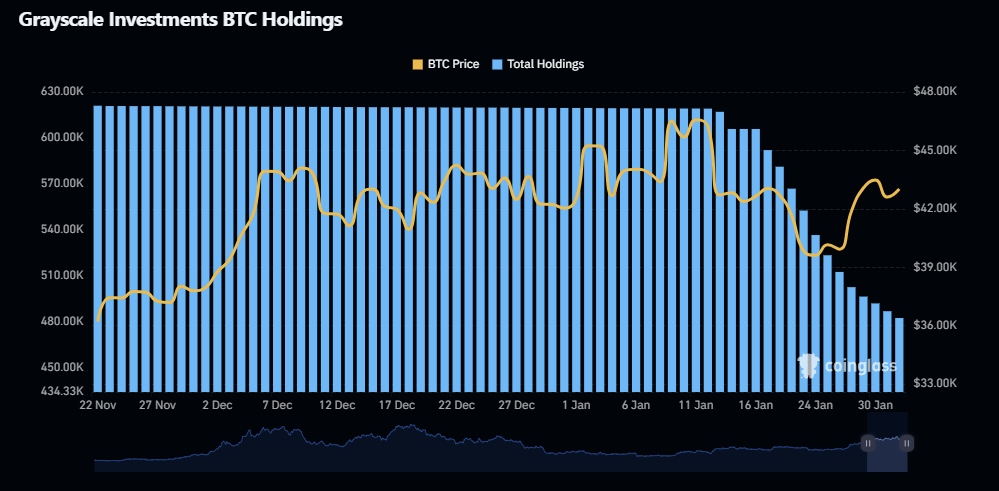

A. ETF Inflows Rise Amidst Slowing GBTC Redemptions

This week marked a increase in ETF inflows, accompanied by a reduction in GBTC redemptions from mid-January levels, signaling an improvement in market sentiment.

Source - Byzantine General

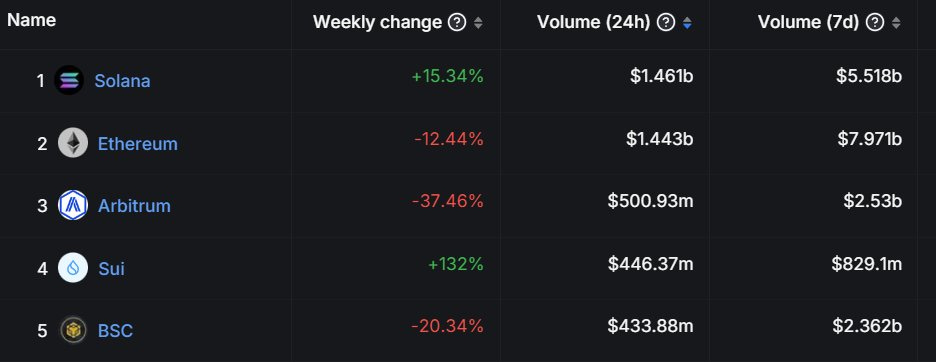

B. Solana And Arbitrum's DEX Volume Challenges Ethereum:

On February 1st, Solana reached parity with Ethereum's DEX volume, and Arbitrum achieved over a third of it.

Additionally, Sui outperformed the Binance Smart Chain (BSC), a development pointed out by Patrick Scott.

This data from DeFi Llama illustrates the changing dominance among L1s, marking a clear departure from the market trends of 2021 as we head into 2024.

Source - DeFi Llama

5. Sector Insights:

A. Sui's DeFi Momentum: Surpassing Expectations

Despite the lack of attention, Sui has outpaced Solana in USDT volume transfers, securing the second spot after Ethereum.

Coupled with its parabolic growth in TVL and fees, Sui is rapidly becoming a noteworthy contender in the blockchain arena.

Source - DeFi Llama

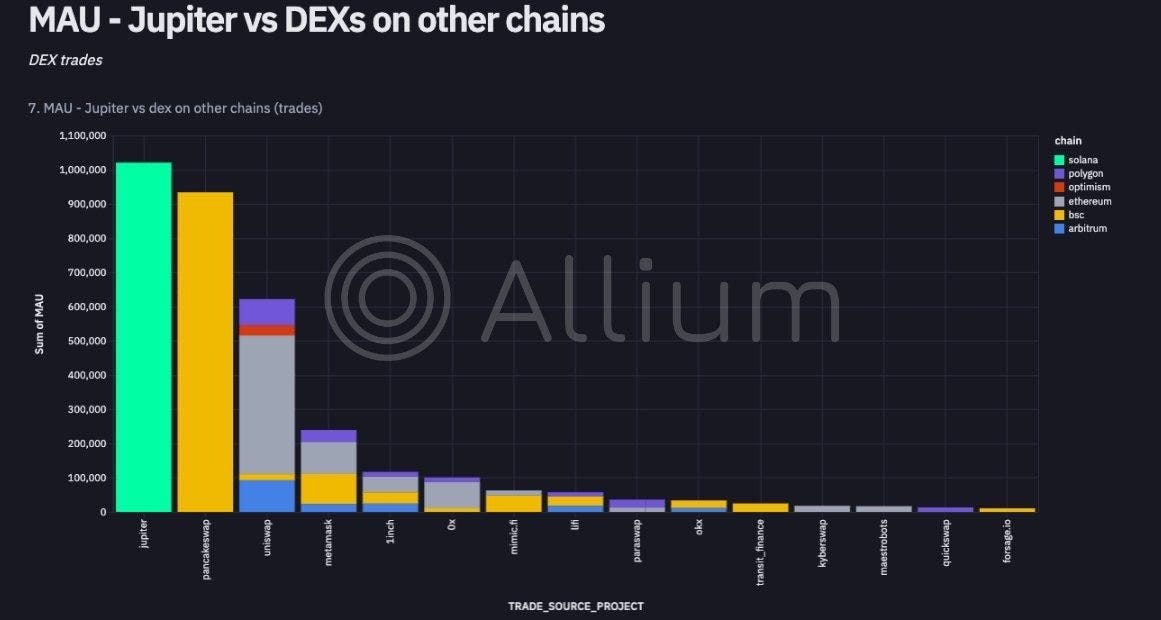

B. Solana's DeFi Leader: Jupiter's Rise

Jupiter, Solana's premier DEX aggregator, now boasts the highest number of monthly active users across DEXS on all chains, overtaking Uniswap.

Source - Allium

Following its token launch and a January 31st airdrop, Jupiter further cements its status in the decentralized exchange space.

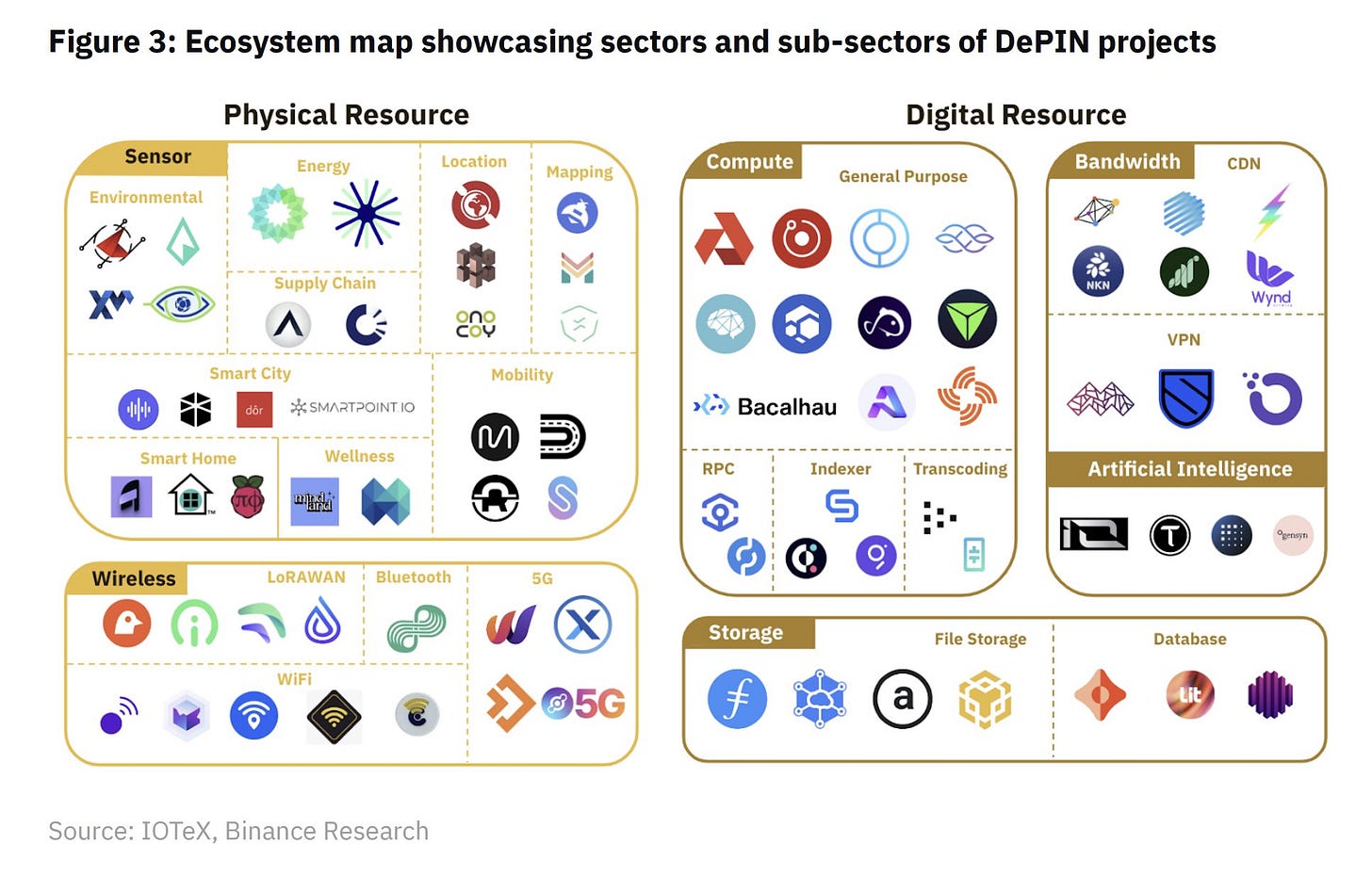

C. Binance Predicts Growth For DePIN Sector:

Binance's latest research report highlights the Decentralized Physical Infrastructure Networks (DePIN) sector, emphasizing its considerable growth potential.

It forecasts an upswing in DePIN projects, mirroring the explosive growth of decentralized applications (dApps) seen in 2020 and 2021

Source - Binance Research

However, the lasting success and viability of these projects hinge on their practical application and real-world effectiveness, which are yet to be thoroughly tested.

6. Educational Tip:

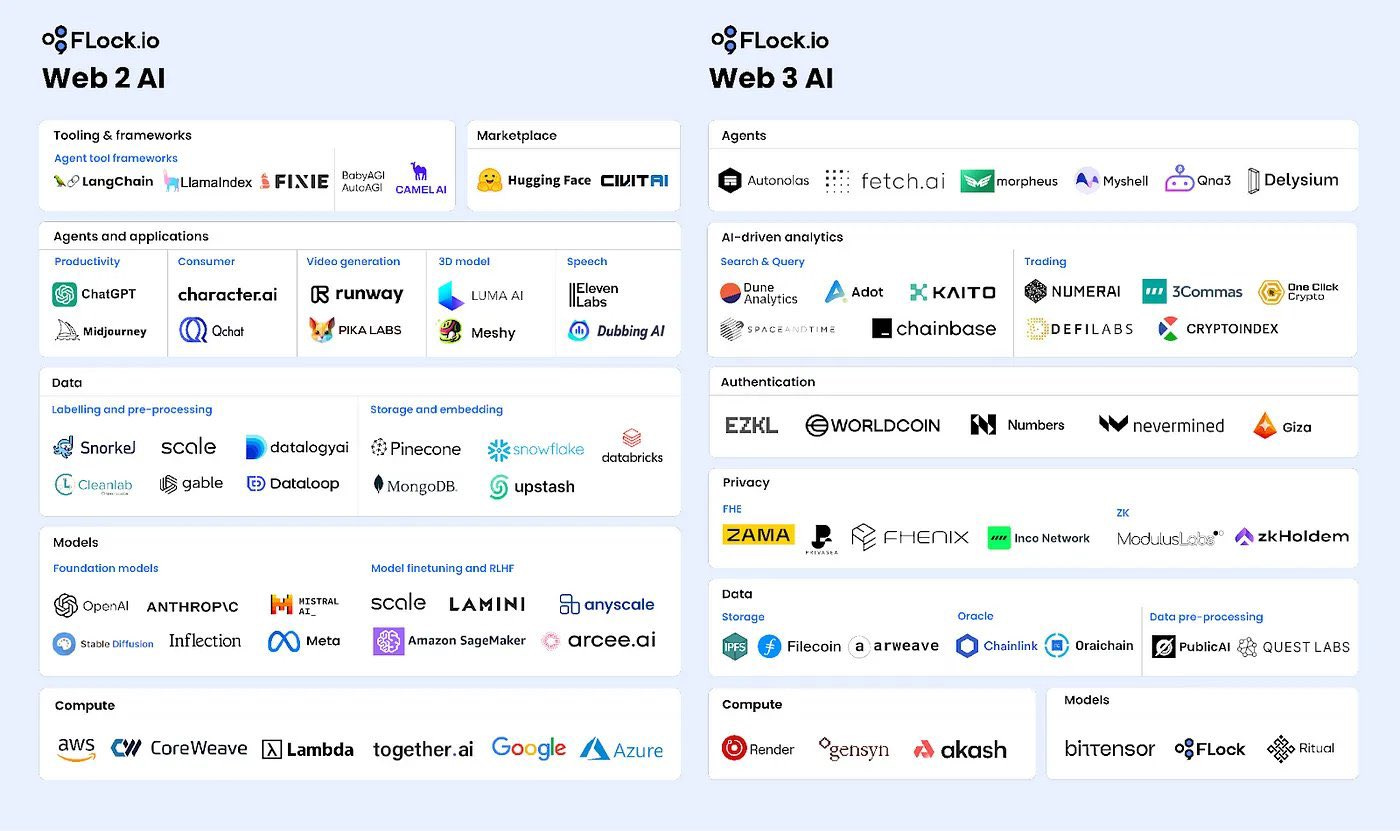

The Web3 AI Ecosystem Unveiled:

The Web3 AI domain is experiencing rapid growth, characterized by a broad and varied range of components best understood through a bottom-up perspective.

The foundation consists of compute power and models — the essential infrastructure and source of fuel. At the apex are agents, key drivers of productivity and agency.

Source - Flock.io

Each element within this ecosystem plays a vital role, yet, in my view, the greatest value is found at both the foundation and the apex. The reason?

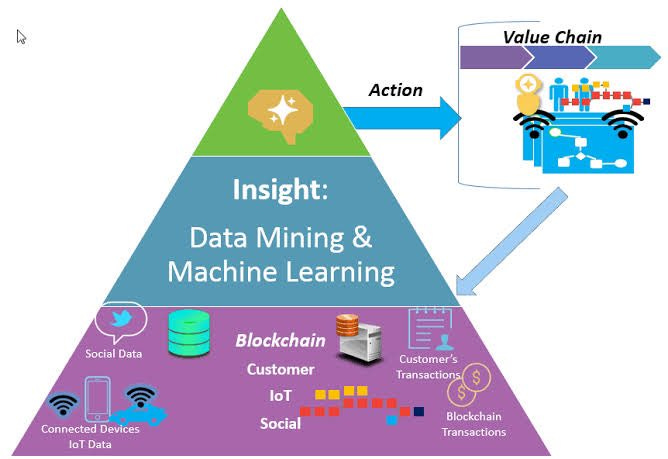

Neural networks and models are at the heart of generating insights, leveraging human knowledge and algorithms to produce new data and patterns.

Conversely, agents are crucial in realizing service value, acting as facilitators by applying machine learning insights and responding to user needs proactively.

Premium Subscriber Section:

Join me as we step it up a notch with our premium section.

Dive into my personal portfolio, investment strategy, altcoin watchlists, and exclusive insights into the emerging opportunities I'm closely monitoring.

My Crypto Portfolio:

Here’s my core crypto investments, listed in order of largest to smallest holdings, reflecting their weight in my portfolio.

Keep reading with a 7-day free trial

Subscribe to Markets, Distilled to keep reading this post and get 7 days of free access to the full post archives.