1. Introduction:

As crypto goes mainstream, the window for "easy gains" is closing.

Sadly, not everyone will make it.

Here are 10 signals and tips to help you time your exit at the cycle's peak (🧵👇).

2. Balloon > Bubble:

The term "bubble" is often overused. Instead, think of the market as a balloon.

While bubbles suggest fragility, a balloon can overinflate, deflate, and stabilize.

The key is to exit gradually as the balloon approaches maximum volume.

3. Navigating The Balloon:

A balloon analogy helps explain why market tops are hard to identify.

No one knows the limit of the balloon.

It's not as simple as waiting for "euphoria" on Twitter or your neighbors to buy BTC.

4. The Need For New Top Signals:

Crypto has many pre-images, blurring the lines between adoption and old top signals.

As the industry matures, so do the signals.

In the last cycle, tracking crypto trading apps via Apple Store rankings was popular.

However, with the rise of BTC ETFs, this approach may no longer be effective.

5. The Stakes Are Higher Than Ever:

2017 was a tulip bubble. 2021 gave us a glimpse of the dream. 202X might be real.

Will it end in a bang or a whimper?

While the outcome is uncertain, this cycle is extremely different.

6. Signal 1 - Too Much Leverage:

Excessive leverage often leads to forced liquidations and crashes.

New, unforeseen risk factors and Ponzi schemes can trigger a cascade effect.

Let's dive into each below:

(i) Rapid De-Risking (and Black Swans):

Rapid de-risking happens when new, unforeseen risks are priced in quickly.

This triggers mass portfolio de-risking, catching overleveraged investors offside.

Example: LUNA crash of 2022.

Source: CoinGape

(ii) Ponzi Schemes:

The mass pursuit of short-term gains, ignoring fundamentals, creates instability.

Too much reliance on price momentum requires a constant influx of "dumb money."

Studying the Tulip bubble provides more insights.

7. Signal 2 - Corporate Treasury Assets:

Numerous companies adding BTC as reserve assets could be a possible signal.

While bullish, it could mean we're further along the adoption curve than many realize.

Even Trump is talking about it now.

Source: Forbes

7. Signal 3 - Sovereign Wealth Funds (SWFs):

Taking it one step further, SWFs may FOMO into BTC, signaling the final exit liquidity.

BlackRock insiders revealed SWF interest.

Examples: Norway ($1.4T fund) or Saudi Arabia ($1T fund).

8. Signal 4 - The Gold Flippening:

In the 2021 cycle, the "flippening" narrative (ETH > BTC) was powerful.

Now, the BTC vs. gold flippening could define this cycle.

As BTC is hailed as digital gold, private and public capitulation may signal the bull run's final stage.

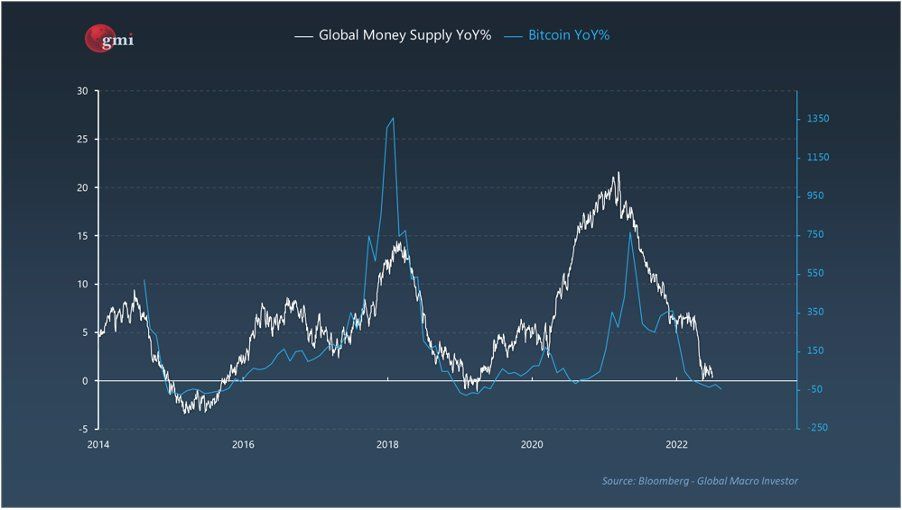

9. Signal 5 - Liquidity Dries Up:

A liquidity crunch is a potential top signal.

Historically, crypto is strongly correlated with the global money supply.

Concerns arise when liquidity surges and tightening looms.

Liquidity tends to lead crypto prices by at least 6 months.

Source: RaoulPal

(i) Running on Fumes:

Without central bank intervention, the mania may persist until the money runs out.

Asset prices accelerate on fumes, but the liquidity fuel has dried up far earlier.

10. Psychological Top Signals:

Emotion is a big driver of human behavior, especially in crypto.

Let's dive into two common psychological signs of market tops 👇

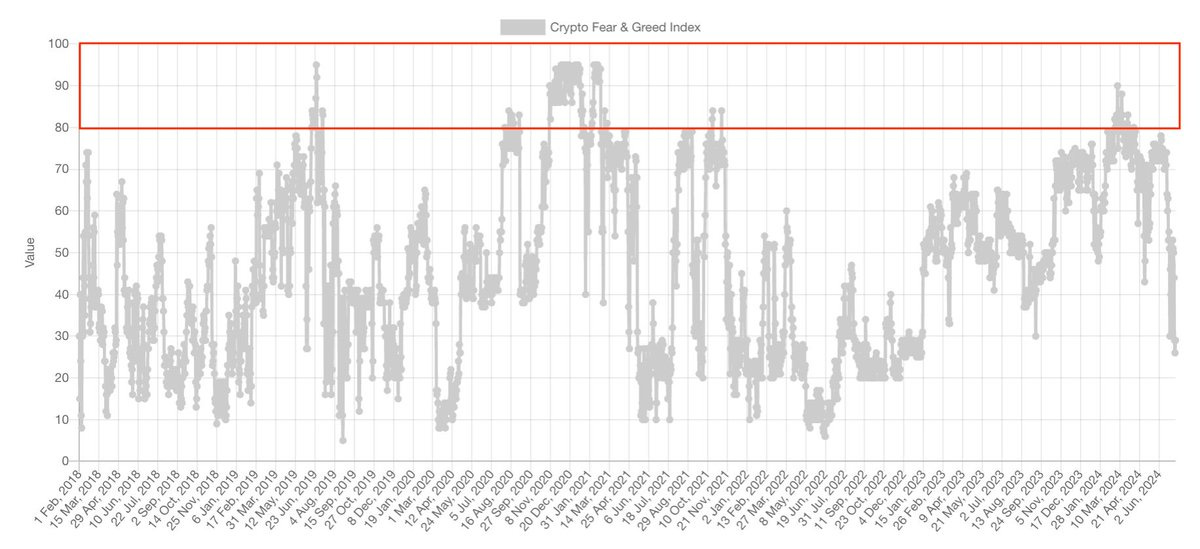

11. Signal 6 - The Fear & Greed Index:

Extended periods of extreme greed can signal looming issues.

They often coincide with excessive leverage and the rise of Ponzi schemes.

A common way to navigate is to simply DCA-out during extreme greed.

Source: Alternative.me

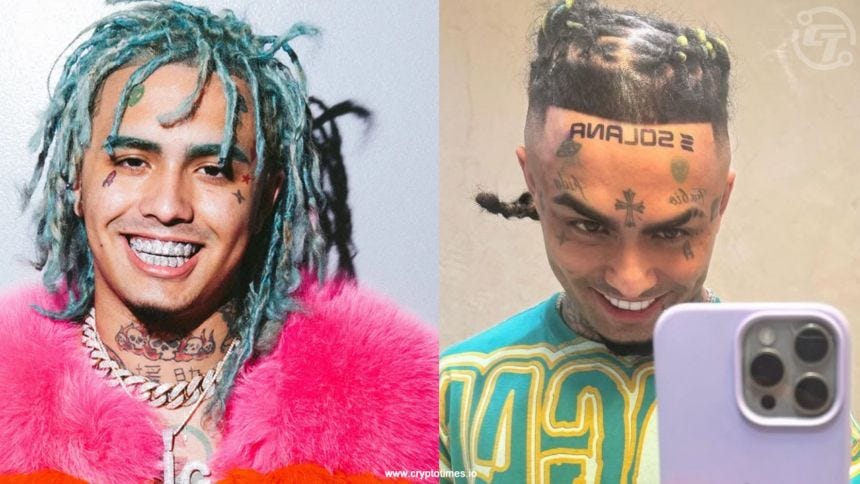

11. Relying On “Average Joe”:

Many time their exit based on when their "dumbest" friends jump into the market.

However, this can be misleading.

For our final signal, let's have some fun and expand on this common strategy 👇

12. Signal 7 - Left Curving:

In the frenzy, your average friends can outperform you by 10x. Why?

Because "left curving" pays off far more during euphoria.

Normies can outperform you again by buying your fundamentally sound coins while you FOMO into theirs.

13. Preparing Yourself Mentally:

You might not time the top, but you can improve your odds by mastering your emotions and training your market intuition.

Here’s how to best prepare yourself 👇

14. Signs Of Adoption Vs. Froth:

Adoption and froth can look similar.

If this cycle truly is different, past patterns may not help at all.

Lean on your intuition and long-term thesis, staying open-minded to paradigm shifts.

15. Emotional Regulation:

Consider potential losses upfront, assuming you might be wrong about your thesis.

For instance, how would you fare if the market has already peaked?

This proactive approach can minimize future pain and financial pitfalls.

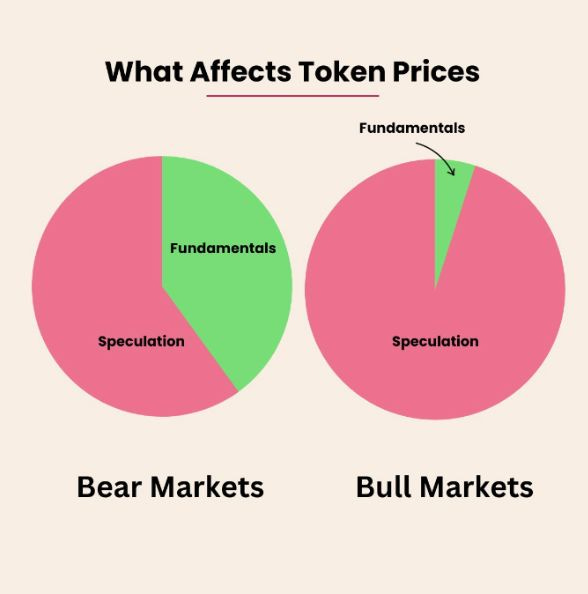

16. Speculation Over Fundamentals:

In risk-on markets, speculation outweighs fundamentals.

Conversely, in risk-off markets, fundamentals take precedence.

However, as the industry matures, fundamentals are becoming increasingly important.

Source: The DeFi Edge

17. We Are All Retail:

While new users may join later, it's crucial to accept that 99% of CT users are "retail."

Many lose money by buying junk to sell to "dumb retail money" later.

In the final stages of a bull run, it's simply a race to take profit.

18. Leave Some Gains On The Table:

Combat your greed by leaving some meat on the bone for others.

For example, aim to exit fully in the top third of the cycle (not at the exact peak).

Treat counterparts with respect to avoid being disrespected by the market.

19. Thread Summary:

Monitor institutional greed (Corporates + SWFs)

Stay vigilant for new/potential black swans

Be wary of excessive leverage/Ponzis

Study the liquidity (altcoins follow closely)

Leave some gains on the table for others

Disclaimer:

Please note that all content is for informational purposes only and should not be considered financial advice. For full details, see the disclaimer.