Welcome to the 32th edition of Markets, Distilled — your edge on where capital’s flowing across the exponential age.

Report Highlight: The Next MSTR?

We spotlighted MTPLF on May 23 as a reflexive treasury play rivaling MSTR.

Since then, it’s surged +56.78% as BTC holdings jumped from 7,800 to 13,350.

Join 250+ readers positioning early across exponential age themes.

1. Market Overview:

A. China’s Tech Slowdown:

China’s AI hype peaked with DeepSeek R1—but the rally fizzled as the U.S. Mag7 pulled ahead.

The “China takeover” narrative backfired, accelerating U.S. model rollouts instead.

Tightened export controls choked China’s chip access, delaying DeepSeek R2 and stalling momentum. For now, the AI edge firmly belongs to the U.S.

Source: Shanghai Macro on X

B. The Next Treasury Play:

BMNR pivoted from BTC mining to ETH stacking after a $250M raise—and surged +2,870%.

With SBET as the only other ETH treasury play, flows are highly concentrated.

Watch ETHBTC closely: any breakout could light a fire under this micro-sector.

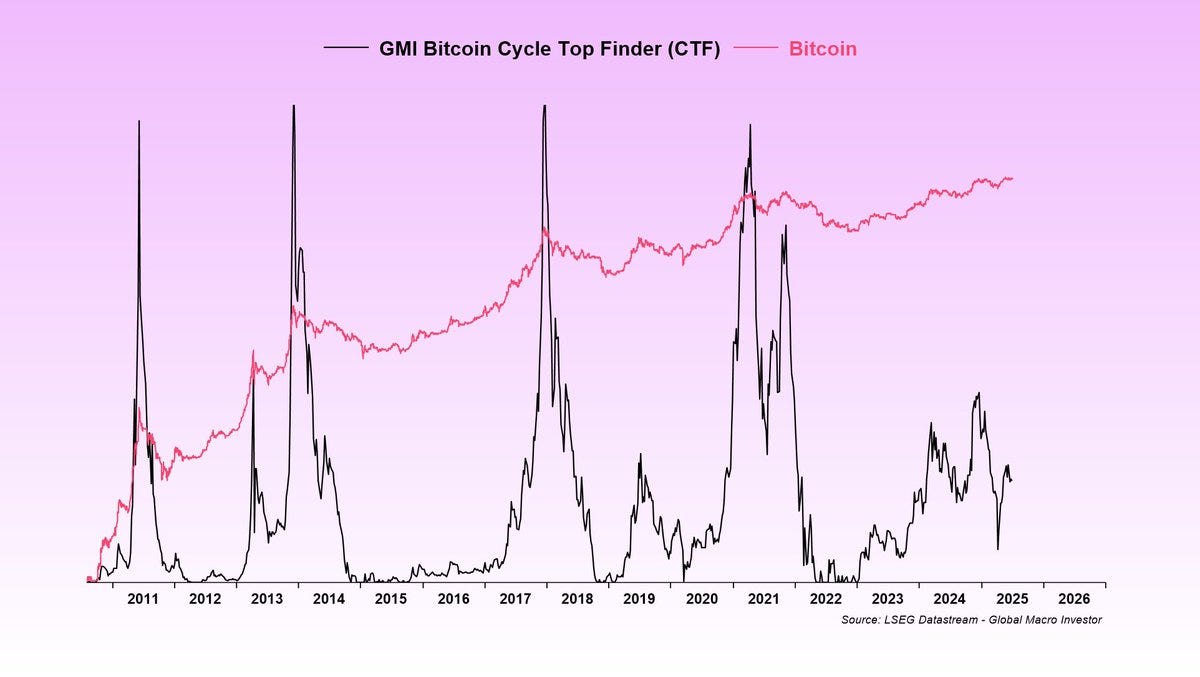

C. BTC’s Top Indicator:

GMI’s Cycle Top Finder—spot-on in past BTC peaks—remains well below danger zones, signaling upside remains.

Pi Cycle Top now points to ~$170K as a likely top range.

Source: Julien Bittel on X

📈 Join 250+ paid readers across the Exponential, Distilled brand.

Keep reading with a 7-day free trial

Subscribe to Markets, Distilled to keep reading this post and get 7 days of free access to the full post archives.