Welcome to the 33rd edition of Markets, Distilled — your edge on where capital’s flowing across the exponential age.

Report Highlight: Early On Copper

We spotlighted copper on April 6 for its structural role in AI and EVs. Since then:

Copper: +17.9% on rising demand

FCX: +58.4% as the top U.S. copper miner

CRWV: +203.8%—operates copper-intensive AI data centers

Join 250+ readers getting in early on exponential age trends.

1. Market Overview:

A. U.S-China Tension Eases:

China eased rare earth magnet exports just as the U.S. lifted chip software bans—a clear trade truce signal.

Chip design leaders SNPS, CDNS, and SIE rallied, turning YTD positive.

This may be the first domino in broader global trade easing, with China leading the reset.

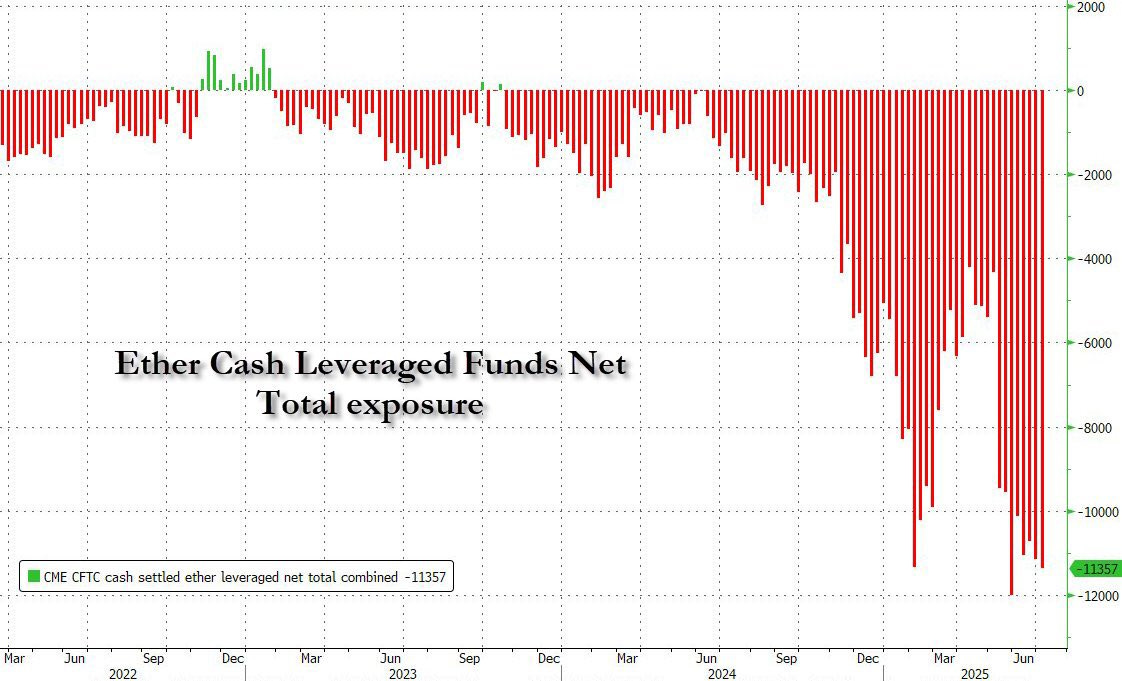

B. ETH Setup: Squeeze Incoming?

ETH is rallying, yet funds remain net short at record highs—skepticism is clear.

Meanwhile, ETH ETFs keep pulling in capital, and treasuries are quietly accumulating.

Add in ETHBTC strength on the daily, and a short squeeze may be taking shape.

Source: EthereanVibin on X

C. Follow The Momentum:

U.S. equities are riding a reflexive wave, with capital flooding into AI, crypto, biotech, and other frontier themes.

Momentum ETFs like SPMO and MTUM are outperforming SPX and QQQ by riding this trend, proving reflexivity pays.

Keep reading with a 7-day free trial

Subscribe to Markets, Distilled to keep reading this post and get 7 days of free access to the full post archives.