Welcome to the 27th edition of Markets, Distilled — your edge on where capital’s flowing across the exponential age.

Explore key insights from top minds, emerging trends, and game-changing topics, all streamlined for you.

1. Market Overview:

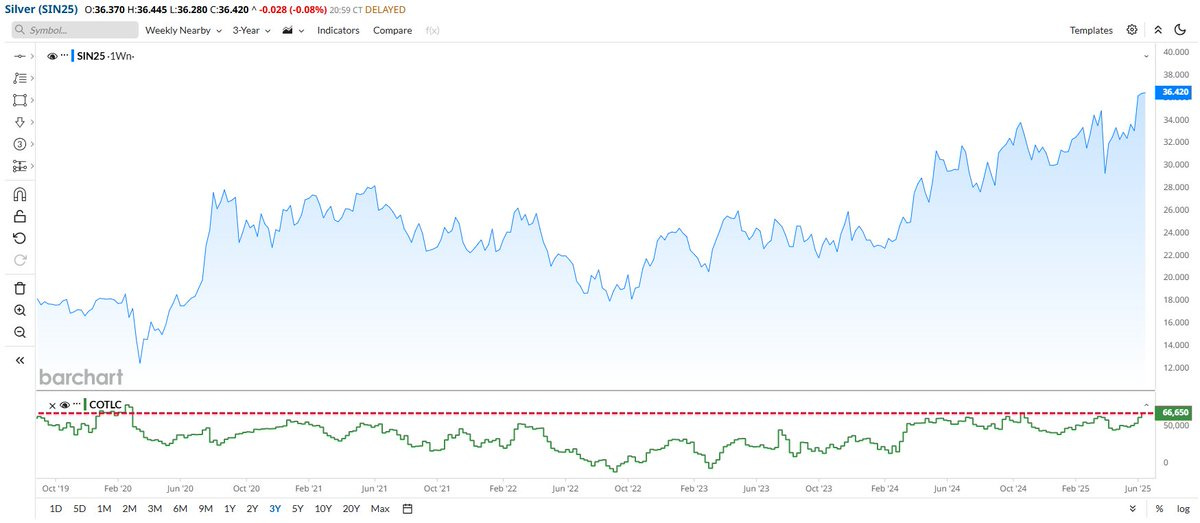

A. Silver Continues Its Shine:

Futures net-longs just matched Feb-2020 highs—the springboard for that +60% surge.

Gold/Silver ratio is breaking down on a fresh 30-month trend flip.

With gold stuck in range, liquidity is rotating into the high-beta metal—silver.

Source: Barchart on X

B. Capital’s Great Rotation: U.S. → Abroad

Dollar softness + Treasury outflows are fueling a shift toward fiscally sound, stronger-currency regions.

EU has pulled in $82.5B YTD as cuts + stimulus boost risk appetite. Asia rides low debt + growth rebound.

Valuations support the shift: U.S. (20.4x), EU (13.5x), Asia (14.2x)

Global ETFs are running: IEUR +19.04%, EEMA +11.81% vs SPX +1.72% YTD.

Source: Reuters

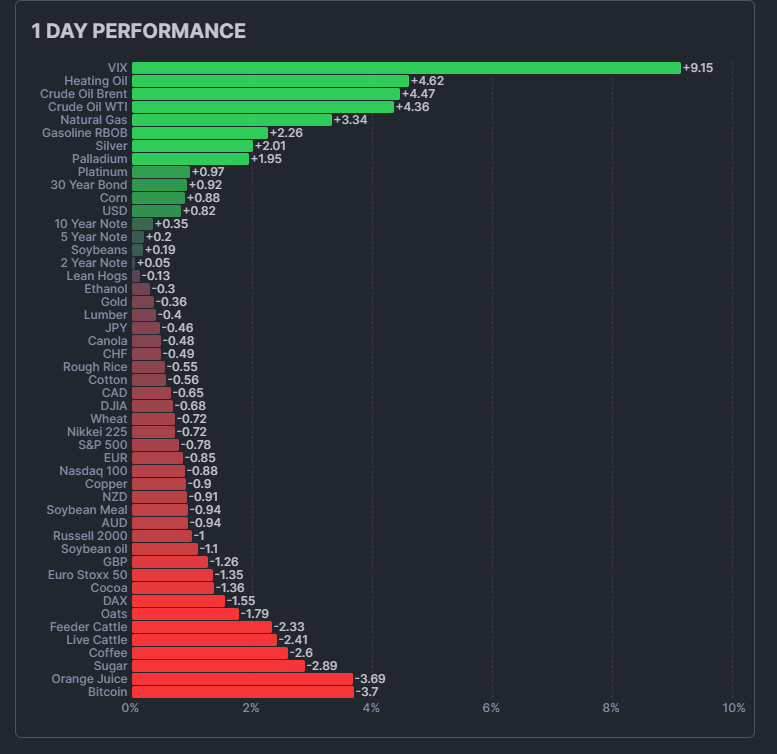

C. War Premium Returns:

Geopolitical tension is flaring as Israel–Iran conflict escalates, with U.S. intervention risk looming.

VIX spiked +9.15%, while energy and metals rally on supply shock fears.

BTC and equities are fading as risk gets cut—defensive flows likely persist until clarity returns.

Source: Mike Zaccardi on X

📈 Join 250+ paid readers across the Exponential, Distilled brand.

2. OpenAI Betas:

A. OpenAI - AI’s First Mover:

ChatGPT sparked AI’s breakout—and OpenAI now sits atop a $300B valuation.

With no public ticker, capital is rotating downstream—into public names linked to OpenAI or Sam Altman, chasing indirect exposure to the AI epicenter.

Keep reading with a 7-day free trial

Subscribe to Markets, Distilled to keep reading this post and get 7 days of free access to the full post archives.